Buzz Haven: Your Source for Trending Insights

Stay updated with the latest buzz in news, trends, and lifestyle.

Don't Get Played: Navigating the Insurance Arena

Master the insurance game! Uncover expert tips and tricks to avoid getting played and secure the best coverage for your needs.

Understanding Insurance Jargon: A Beginner's Guide

When navigating the world of insurance, it's easy to feel overwhelmed by the complex terminology. Understanding insurance jargon is crucial for making informed decisions about your coverage. Terms like premium, deductible, and copayment need to be demystified. A premium is the amount you pay for your policy, either monthly or annually, while a deductible is the amount you must cover out of pocket before your insurance kicks in. Familiarizing yourself with these terms enables you to select a policy that best suits your needs.

In addition to basic terms, it's essential to grasp certain key concepts that could significantly impact your coverage. For example, understanding the difference between actual cash value and replacement cost can affect how much compensation you receive in the event of a claim. Actual cash value reimburses you for the cost of an item minus depreciation, whereas replacement cost provides the amount needed to replace the item without factoring in depreciation. By comprehending these nuances, you empower yourself to engage with insurance providers more effectively and make choices that align with your financial situation.

How to Identify Red Flags in Insurance Policies

Identifying red flags in insurance policies is crucial for ensuring that you are adequately protected. Start by carefully reviewing the policy language. Look for vague terms or conditions that might leave you vulnerable when making a claim. For example, if a policy uses language like 'reasonable' or 'discretionary,' it could indicate that the insurer has considerable leeway in deciding if a claim is valid. Additionally, examine the exclusions; anything that seems unexplained or overly specific could suggest potential loopholes that the insurer might exploit.

Next, pay close attention to the premiums and deductibles. If the policy has unusually low premiums, it may be a warning that coverage is minimal or that there could be hidden costs. Moreover, consider the claims process outlined in the policy; a complicated, lengthy procedure to file a claim is often a sign of trouble. Always ask yourself: Is this policy designed to protect me, or is it structured to benefit the insurer? By knowing what to look out for, you can make more informed decisions about your insurance options.

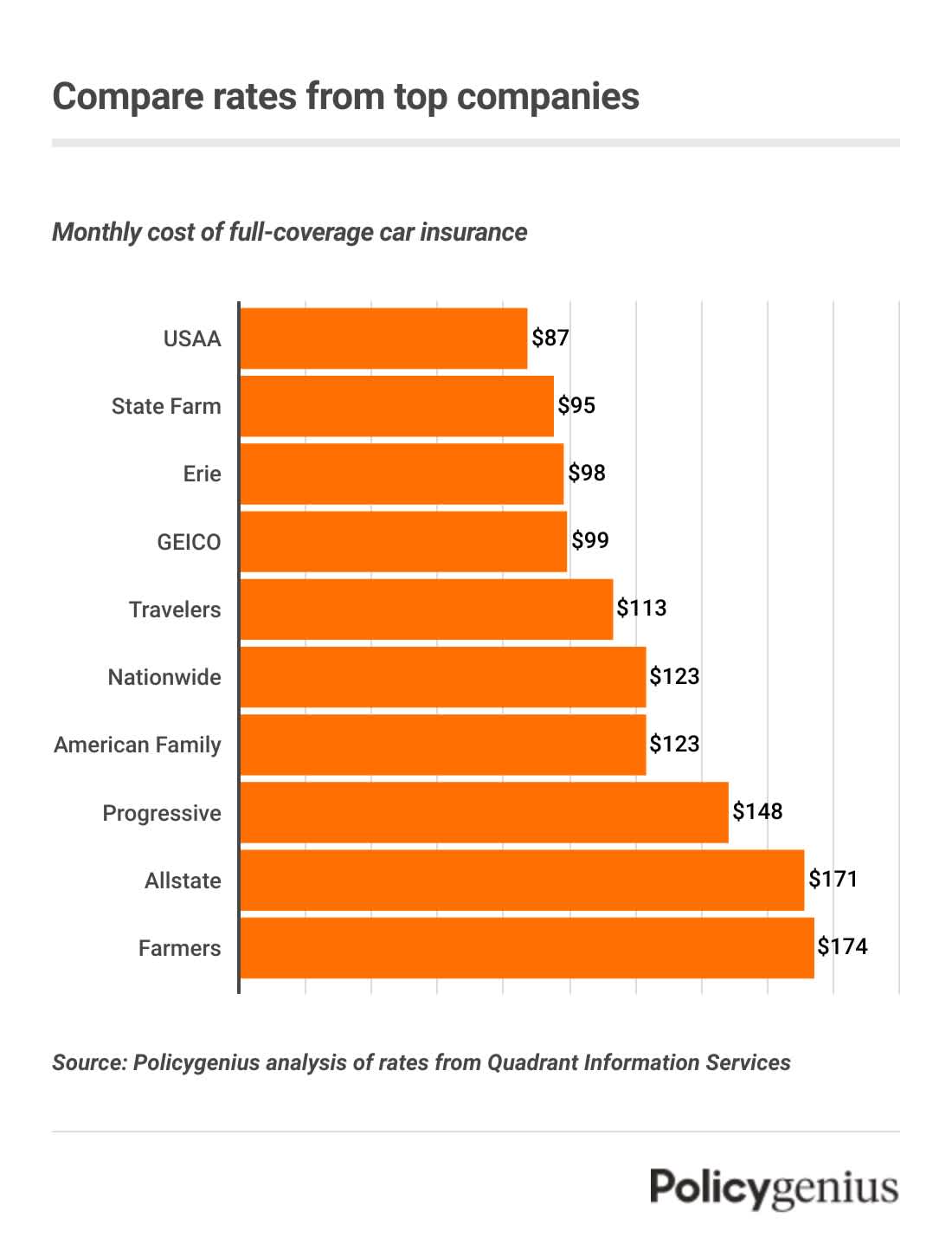

Are You Getting the Best Deal? Tips for Comparing Insurance Quotes

When it comes to finding the best deal on insurance, comparing quotes is essential. Start by gathering multiple quotes from various providers to ensure you're considering all your options. Comparing insurance quotes can be a straightforward process if you follow these steps:

- Identify your coverage needs to ensure you're comparing similar policies.

- Use online comparison tools to streamline your search.

- Check each provider's reputation by reading customer reviews.

Don't forget to consider all aspects of the policy beyond the premium price. Look for coverage limits, deductibles, and additional benefits, as cheaper policies may lack essential features. Also, inquire about possible discounts such as those for bundling multiple policies or maintaining a claim-free history. Remember, the best deal is not solely about the lowest price but also about the overall value it provides. Keep these factors in mind as you navigate your options, and you'll be well on your way to securing the most advantageous insurance deal available.