Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Insurance Showdown: Who's Got Your Back?

Discover the ultimate insurance showdown! Uncover which providers really have your back and secure your peace of mind today!

Understanding Different Types of Insurance: Which One Fits Your Needs?

When it comes to insurance, understanding the various types available can help you make informed decisions that suit your unique needs. Health insurance provides coverage for medical expenses, while life insurance offers financial support to your beneficiaries in the event of your passing. Additionally, auto insurance protects you against losses related to vehicle accidents, and homeowners insurance safeguards your property from damage or theft. Each type serves a specific purpose, and recognizing their differences is crucial for effective financial planning.

To determine which type of insurance fits your needs, it’s important to assess your individual circumstances. Consider factors such as your age, health status, and financial obligations. For instance, if you have dependents, life insurance might be a priority. Alternatively, if you are a homeowner, securing homeowners insurance could prevent significant financial loss in case of emergencies. To help you evaluate your options, here’s a brief checklist:

- Identify your assets and liabilities.

- Evaluate your health and lifestyle.

- Consider your long-term financial goals.

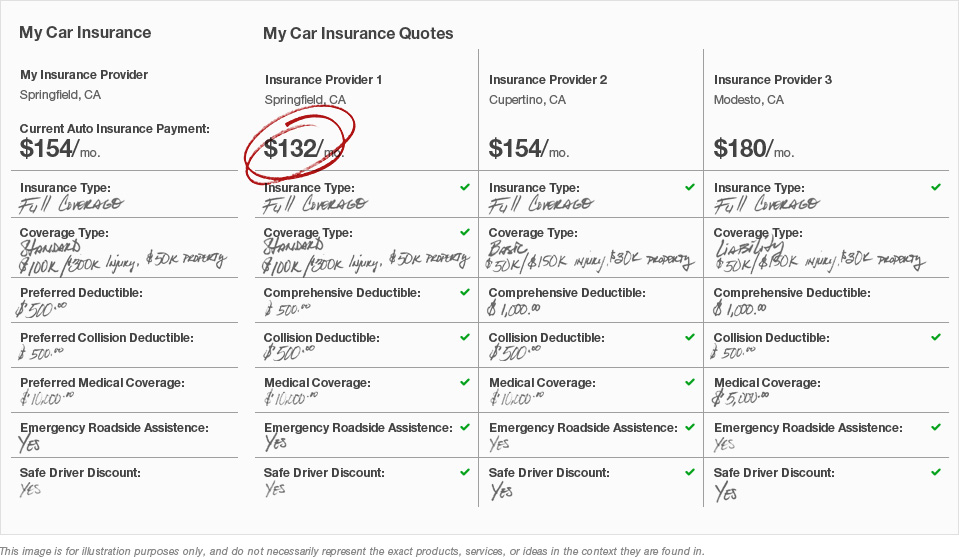

Insurance Providers Compared: Who Offers the Best Coverage?

When it comes to choosing an insurance provider, understanding the differences in coverage options is crucial. Insurance providers vary significantly in terms of the policies they offer, making it essential to compare their strengths and weaknesses. Here are some key factors to consider:

- Coverage Types: Some providers specialize in specific types of insurance, while others offer a broad range of options.

- Cost: Premiums can vary greatly between companies, often for similar levels of coverage.

- Customer Service: The quality of support and claims handling can significantly impact your overall experience.

In a comprehensive comparison, companies like Provider A often stand out due to their extensive coverage options, competitive pricing, and positive customer reviews. On the other hand, Provider B may excel in specific areas such as auto insurance or homeowners insurance, but might not offer the same value in other types. Ultimately, the best way to determine who offers the best coverage is to analyze your personal needs and evaluate what each provider brings to the table based on coverage limits, exclusions, and additional benefits they provide.

5 Questions to Ask Before Choosing Your Insurance Company

Choosing the right insurance company can be a daunting task, but asking the right questions can simplify the process. Start by asking yourself, What types of coverage do I need? This question helps determine whether you need auto, home, health, or life insurance. Knowing your specific needs will guide you to companies that specialize in those areas and can offer tailored policies. Additionally, consider asking about the company’s financial stability. Check their ratings from independent agencies to ensure they have a solid track record of meeting their obligations.

Another critical question to consider is, What are the premiums and deductibles? Understanding the costs associated with your policy is essential for budgeting and ensuring you can afford the coverage. Don’t forget to ask about discounts that may apply to you, which can significantly reduce your premium. Finally, inquire about the claims process: How easy is it to file a claim, and how quickly can I expect to be compensated? Knowing how the company handles claims is vital, as it assures you that in a time of need, they will provide efficient and effective service.