Buzz Haven: Your Source for Trending Insights

Stay updated with the latest buzz in news, trends, and lifestyle.

Disability Insurance: Because Life Throws Curveballs

Discover how disability insurance can protect your income when life throws unexpected challenges your way. Don't wait until it's too late!

Understanding Disability Insurance: What You Need to Know

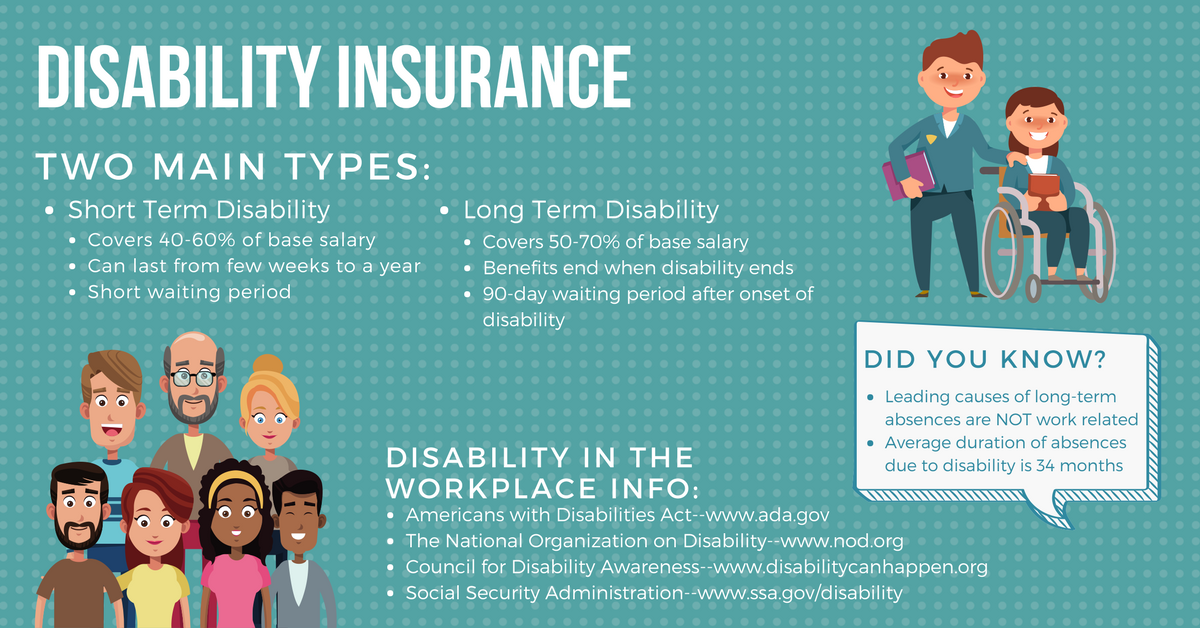

Understanding disability insurance is crucial for anyone looking to safeguard their financial future in the event of an unforeseen disability. This type of insurance provides income replacement if you become unable to work due to illness or injury. Many policies cover both short-term and long-term disabilities, ensuring that you receive financial support during your recovery. It's important to assess your needs and consider the terms of different policies, as coverage amounts and waiting periods can vary significantly.

When selecting a disability insurance policy, consider the following factors:

- Benefit Period: The length of time you will receive payments if you are disabled.

- Elimination Period: The waiting period before benefits begin.

- Definition of Disability: Ensure you understand how the policy defines 'disability' as this can affect your eligibility for benefits.

How Disability Insurance Can Protect Your Income: A Comprehensive Guide

Disability insurance is a vital financial safety net that offers essential protection for your income in the event of an unforeseen illness or injury. When you are unable to work, disability insurance ensures that you can still meet your financial obligations without sacrificing your quality of life. It typically provides a percentage of your pre-disability income, which can cover essential expenses such as housing, groceries, and healthcare costs. Having this coverage not only alleviates financial stress but also offers peace of mind, allowing you to focus on your recovery rather than worrying about your finances.

There are two main types of disability insurance—short-term and long-term disability insurance. Short-term disability insurance usually covers you for a few months, while long-term disability insurance can provide income replacement for several years or even until retirement. When considering a policy, it is important to evaluate factors such as waiting periods, benefit durations, and coverage amounts. Investing in disability insurance is not just a protective measure; it's a proactive strategy to secure your financial future and protect your lifestyle against unexpected challenges.

Is Disability Insurance Worth It? Common Questions Answered

Determining whether disability insurance is worth it often hinges on individual circumstances. Many people overlook the importance of this type of coverage, thinking it unlikely they would suffer a disabling condition. However, statistics show that approximately 1 in 4 workers will experience a disability before retirement age. In light of this, disability insurance can serve as a crucial safety net, ensuring that you can maintain your financial stability in the event of unexpected health issues. Consider your current financial obligations and whether you could manage them without your income.

When evaluating disability insurance, it's common to have questions regarding its necessity, coverage details, and costs. Here are a few frequently asked questions:

- What does disability insurance cover? It typically provides income replacement if you become unable to work due to illness or injury.

- How much does it cost? Premiums depend on factors like your age, health, occupation, and the amount of coverage you choose.

- Is it worth the investment? For many, the peace of mind and financial protection it offers makes it a valuable investment.