Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Ditching Fees: How to Cash in on Auto Insurance Discounts Like a Pro

Unlock hidden auto insurance discounts and save big! Discover expert tips to ditch fees and maximize your savings like a pro!

Maximize Your Savings: The Ultimate Guide to Auto Insurance Discounts

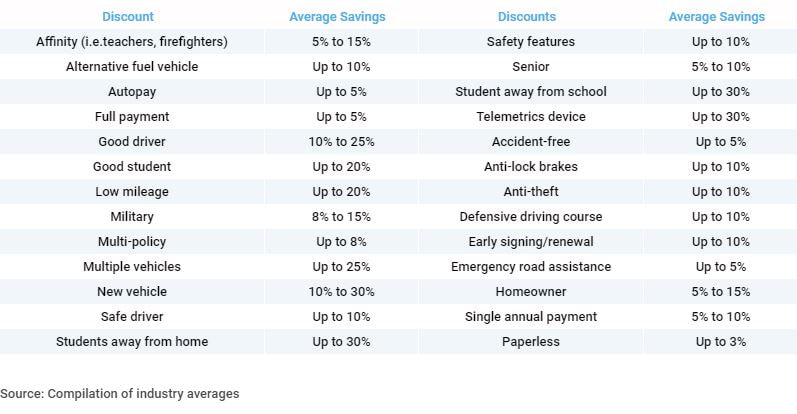

Finding ways to maximize your savings on auto insurance can make a significant difference in your monthly budget. One of the first steps to uncovering potential discounts is to evaluate your current policy and understand the various factors that insurance companies consider when determining premiums. Many providers offer a range of discounts, including safe driver incentives, bundling discounts for combining multiple policies, and even loyalty rewards for long-term customers. Don't hesitate to ask your insurance agent about available options—your proactive approach could lead to substantial savings.

In addition to the common discounts, there are some lesser-known ways to cut costs on your auto insurance. For instance, maintaining a good credit score can significantly affect your premium rates, as many insurers offer credit-based discounts. Participating in a defensive driving course can also qualify you for lower rates, showcasing your commitment to safer driving practices. Finally, consider the vehicle type you drive; some cars are inherently cheaper to insure due to their safety ratings and repair costs. By exploring these options, you can truly optimize your policy and maximize your savings.

Unlock Hidden Discounts: What You Need to Know About Auto Insurance Savings

Finding auto insurance savings can feel like a daunting task, but there are several hidden discounts you may not be aware of that can significantly reduce your premiums. Many insurance companies offer discounts for factors such as safe driving records, multiple policies, and even being a member of certain organizations. Unlock hidden discounts by asking your insurance provider about available options. For instance, maintaining a clean driving record could qualify you for a safe driver discount, while bundling your auto insurance with home or renters insurance may yield a substantial savings.

Additionally, don’t overlook discounts related to vehicle features and usage. Many insurers offer breaks for cars equipped with advanced safety features like anti-lock brakes and airbags, as these reduce the risk of accidents. Another opportunity arises with low mileage: if you drive less than a certain number of miles annually, you may qualify for a low mileage discount. Consider reaching out to your insurer for a personalized review of your policy to ensure you’re taking full advantage of all potential savings and unlock hidden discounts.

Are You Missing Out? Essential Tips to Secure Auto Insurance Discounts

Many drivers are unaware of the numerous opportunities available to save on their auto insurance premiums. One of the most effective ways to unlock these savings is by taking advantage of auto insurance discounts. For instance, consider bundling your auto policy with other types of insurance, such as home or renters insurance, which could lead to significant savings. Additionally, maintaining a clean driving record by avoiding accidents and traffic violations can earn you a safe driver discount. Be sure to inquire about all available discounts when shopping for policies or renewing your coverage.

Another key strategy in securing auto insurance discounts is to evaluate your vehicle’s safety features. Many insurance companies offer reductions for cars equipped with advanced safety technology, like anti-lock brakes, airbags, and theft deterrent systems. Additionally, consider participating in defensive driving courses; these not only enhance your driving skills but can also earn you extra discounts. Lastly, regularly reviewing your policy and comparing quotes can help you find better rates and maximize your savings. Don’t miss out on these valuable tips to keep your auto insurance costs low!