Buzz Haven: Your Source for Trending Insights

Stay updated with the latest buzz in news, trends, and lifestyle.

The Joyride to Affordable Auto Insurance

Discover the secrets to affordable auto insurance and hit the road with peace of mind—your wallet will thank you!

Understanding the Basics of Affordable Auto Insurance

Understanding the basics of affordable auto insurance is crucial for any vehicle owner. It helps to have a clear grasp of how different coverage options work, including liability, collision, and comprehensive insurance. Liability coverage is typically the minimum legal requirement, protecting you against claims from other drivers in the event of an accident. Meanwhile, collision coverage pays for damage to your own vehicle, while comprehensive coverage safeguards against non-collision threats such as theft or natural disasters. By knowing these fundamentals, you can make informed decisions that suit your budget and risk tolerance.

When shopping for affordable auto insurance, it’s important to compare quotes from various providers. Insurance companies consider factors such as your driving history, the make and model of your car, and your location when determining your premium. Additionally, consider increasing your deductible to lower your monthly payments; however, ensure that you can afford the out-of-pocket cost in the event of a claim. Prioritizing safety features in your vehicle can also lead to discounts. Always review your policy and coverage options annually to ensure you’re getting the best deal possible.

5 Tips to Find the Best Deals on Auto Insurance

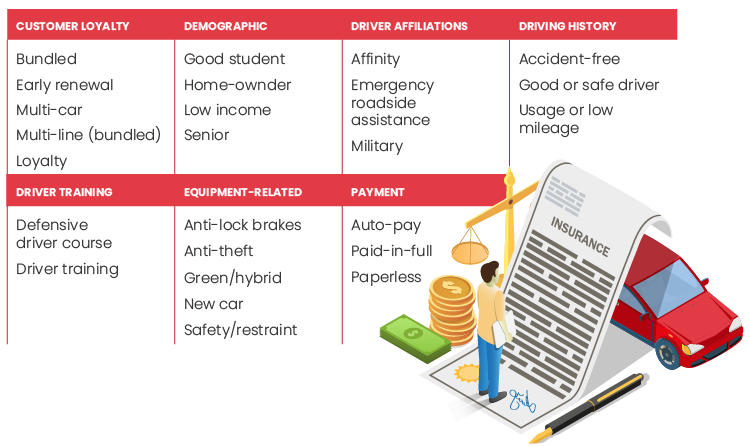

Finding the best deals on auto insurance can feel overwhelming, but with the right strategies, you can save both time and money. One of the most effective tips is to compare quotes from multiple insurance providers. Using online comparison tools can help streamline this process, allowing you to evaluate different coverage options and premiums side by side. Don't forget to check for discounts—many insurers offer reductions for safe driving records, bundling policies, or even for being a member of certain organizations.

Another key tip is to review your coverage regularly. As your needs change, so should your policy. For instance, if your vehicle's value has decreased, you might consider dropping comprehensive coverage or raising your deductible to lower your premium. Additionally, consider taking a defensive driving course; this not only enhances your skills behind the wheel but can also result in significant savings on your auto insurance. Following these tips can significantly increase your chances of finding the best deals on auto insurance.

Common Misconceptions About Affordable Auto Insurance

Many individuals believe that affordable auto insurance implies a compromise in coverage. This misconception often arises from the assumption that lower premiums equate to fewer benefits or inadequate protection. In reality, there are numerous options available that provide both affordability and comprehensive coverage. Insurance companies often offer various discounts, such as safe driver discounts or bundling policies, which enable drivers to secure substantial savings without sacrificing essential coverage.

Another common fallacy is that only high-risk drivers can benefit from affordable auto insurance. Contrary to this belief, drivers of all risk levels can find competitive rates. Many insurers assess a wide range of factors, including driving history, vehicle type, and even credit score, when determining premiums. As a result, even those with excellent driving records can take advantage of lower-cost policies that still provide the coverage they need to stay protected on the road.