Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Offshore Banks: Secrets the Wealthy Won't Share

Uncover the hidden treasures of offshore banking that the wealthy keep to themselves and secure your financial future today!

5 Offshore Banking Myths Debunked: What the Wealthy Know

When it comes to offshore banking, numerous misconceptions often cloud the truth, leading many to shy away from the numerous benefits these accounts can offer. One prominent myth is the belief that offshore banking is solely for the ultra-wealthy or criminals. In reality, these banking solutions attract a diverse clientele, including individuals seeking asset protection, better investment opportunities, and privacy. As more people embrace financial empowerment, it's essential to understand that offshore banking can be a legitimate strategy for wealth management for anyone looking to safeguard their finances.

Another common myth suggests that offshore banks are inherently risky and unregulated. However, many of these institutions operate in strictly regulated environments, governed by international laws designed to protect depositors. Countries like Switzerland and Singapore have established robust banking regulations, ensuring that customer funds are secure and safeguarded. By debunking these myths, individuals can harness the advantages of offshore banking while making informed decisions that align with their financial goals.

How to Choose the Right Offshore Bank: A Step-by-Step Guide

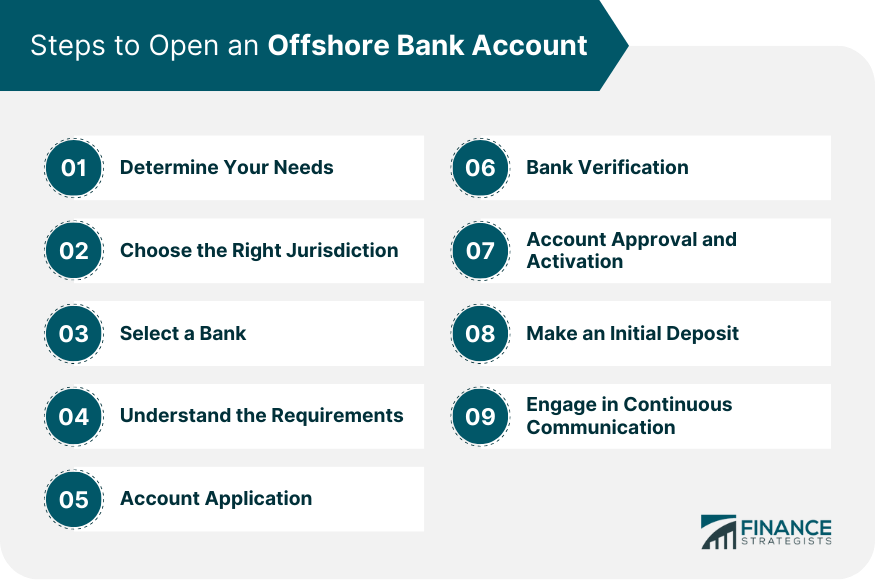

Choosing the right offshore bank is a critical step in managing your finances and maximizing your investment opportunities. Start by researching the bank's reputation and regulatory compliance. Look for institutions that are well-established and have a track record of reliability and security. It's also essential to understand the laws governing offshore banking in your jurisdiction as well as the bank's country. You should create a list of potential banks, comparing fees, services, and account types to find the best fit for your needs.

Once you have a shortlist, consider the following factors to help you make an educated decision:

- Accessibility: Ensure you can easily access your funds and that the bank provides online banking services.

- Currency options: Look for banks that offer multi-currency accounts if you plan to deal with international transactions.

- Customer support: Reliable customer service is crucial, so opt for banks with good communication options.

- Annual fees and minimum deposit requirements: Be clear about the costs involved in maintaining an account.

Is Offshore Banking Legal? Answers to Common Questions

Offshore banking is often shrouded in mystery, leading many to wonder, is offshore banking legal? The short answer is yes, but it comes with important qualifications. Offshore banking involves opening a bank account in a foreign country, and while this practice is legal in many jurisdictions, it is essential to comply with both the laws of your home country and the regulations of the country where the bank is located. For instance, individuals must report their offshore accounts to tax authorities in accordance with local laws to avoid penalties. Transparency is crucial, so understanding the legal obligations tied to offshore banking is key to staying compliant.

When considering is offshore banking legal, potential account holders often have common questions. Firstly, clients should be aware of the requirement to report income generated from offshore accounts back to their home country. Failing to do so can lead to issues with tax authorities. Secondly, regulatory agencies in many countries are enhancing their monitoring of offshore accounts to combat money laundering and tax evasion. Therefore, the growing trend towards transparency means that individuals must ensure their offshore banking activities are entirely lawful. Consulting with a financial advisor or legal professional can provide valuable guidance on navigating these complexities.