Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Paws and Policies: Why Your Furry Friend Deserves Coverage Too

Discover why your furry friend deserves insurance! Protect their health and happiness with essential pet coverage tips and insights.

Understanding Pet Insurance: What Coverage Looks Like for Your Furry Friend

Understanding pet insurance is crucial for any pet owner who wants to ensure their furry friend's health and well-being. Pet insurance policies can vary widely, but they generally cover a range of veterinary expenses such as accidents, illnesses, and routine care. Most policies include coverage for unexpected medical emergencies, surgical procedures, and hospitalization, while others may also offer options for wellness visits, vaccinations, and preventive care. It's essential to carefully review the different types of plans available, including accident-only coverage, comprehensive policies, and breed-specific options, to determine what suits your pet's needs best.

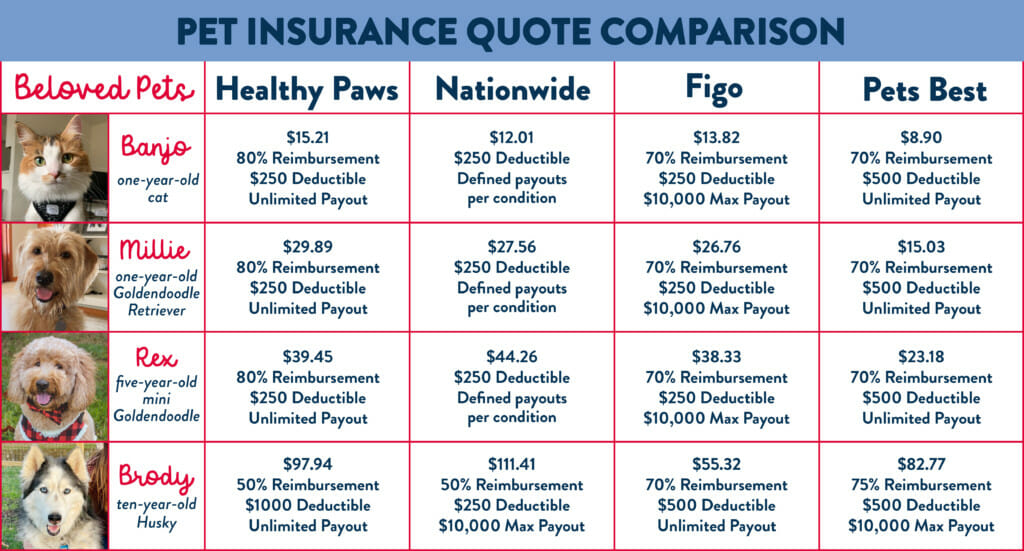

When considering what coverage looks like for your pet, there are a few key factors to keep in mind. Most plans will have a deductible—the amount you'll pay out-of-pocket before the insurance kicks in—as well as premiums and reimbursement rates, which can typically range from 70% to 90%. Additionally, it’s important to be aware of any exclusions or waiting periods associated with specific conditions. As you evaluate policies, consider using a comparison tool to assess various providers and their offerings. This way, you can find a plan that meets both your budget and your pet's specific healthcare needs.

The Essential Guide to Pet Health Care Policies: What Every Pet Owner Should Know

As a responsible pet owner, understanding pet health care policies is crucial to ensuring the wellbeing of your furry companions. These policies outline the necessary steps for routine care, emergency situations, and preventive measures that can help your pet live a longer, healthier life. Familiarize yourself with your veterinarian's health care policies, which may include vaccination schedules, spaying/neutering recommendations, and guidelines for regular check-ups. Additionally, consider the following key aspects:

- Insurance Coverage: Understand what your pet insurance covers and the associated costs.

- Emergency Care Procedures: Know the protocols in case of an emergency and where to take your pet.

- Preventive Care: Stay informed about essential vaccinations and preventive treatments.

Moreover, it's essential to review your pet's health care policies regularly to adapt to any changes in your pet's health needs or new veterinary recommendations. Consider keeping a health journal that tracks your pet's medical history, including vaccinations and medications received, which can help inform future care decisions. Lastly, by adhering to established pet health care policies, you not only protect your pet’s health but also promote responsible pet ownership in your community. Remember, being proactive is key to maintaining your pet's overall health and happiness.

Is Pet Insurance Worth It? Exploring the Benefits for Your Beloved Companion

When it comes to ensuring the well-being of your furry friends, pet insurance can be a valuable resource. With the rising costs of veterinary care, many pet owners are left wondering if investing in insurance is truly worth it. This type of insurance can cover a range of expenses, from routine check-ups to unexpected surgeries, providing peace of mind. As vet bills can quickly add up, especially in emergency situations, having a policy in place can prevent financial strain and allow you to focus on what truly matters: your pet's health.

Moreover, pet insurance often includes various additional benefits, such as coverage for accidents, illnesses, and even certain hereditary conditions. Some policies also offer wellness plans that can help cover preventive care, like vaccinations and dental cleanings. To help you weigh the pros and cons, consider the following key benefits:

- Financial support during unexpected health issues

- Access to a broader range of treatment options

- Peace of mind knowing your beloved companion is protected

Ultimately, the decision to invest in pet insurance depends on your unique circumstances and the needs of your pet. Assessing your budget and your pet's health history can guide you in making an informed choice.