Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Save Big Without Paying Full Price: Crazy Auto Insurance Discounts You Didn't Know Existed

Unlock hidden auto insurance discounts and save big! Discover crazy hacks to lower your premium without breaking the bank.

Top 10 Hidden Auto Insurance Discounts You Shouldn't Miss

When it comes to saving money on your auto insurance, you might be leaving discounts on the table. Here are the top 10 hidden auto insurance discounts you shouldn't miss:

- Bundling Discounts: Many insurers offer savings for combining multiple policies, such as home and auto insurance.

- Good Student Discounts: If you or a young driver on your policy maintains a strong GPA, insurers often provide discounts as a reward for academic achievement.

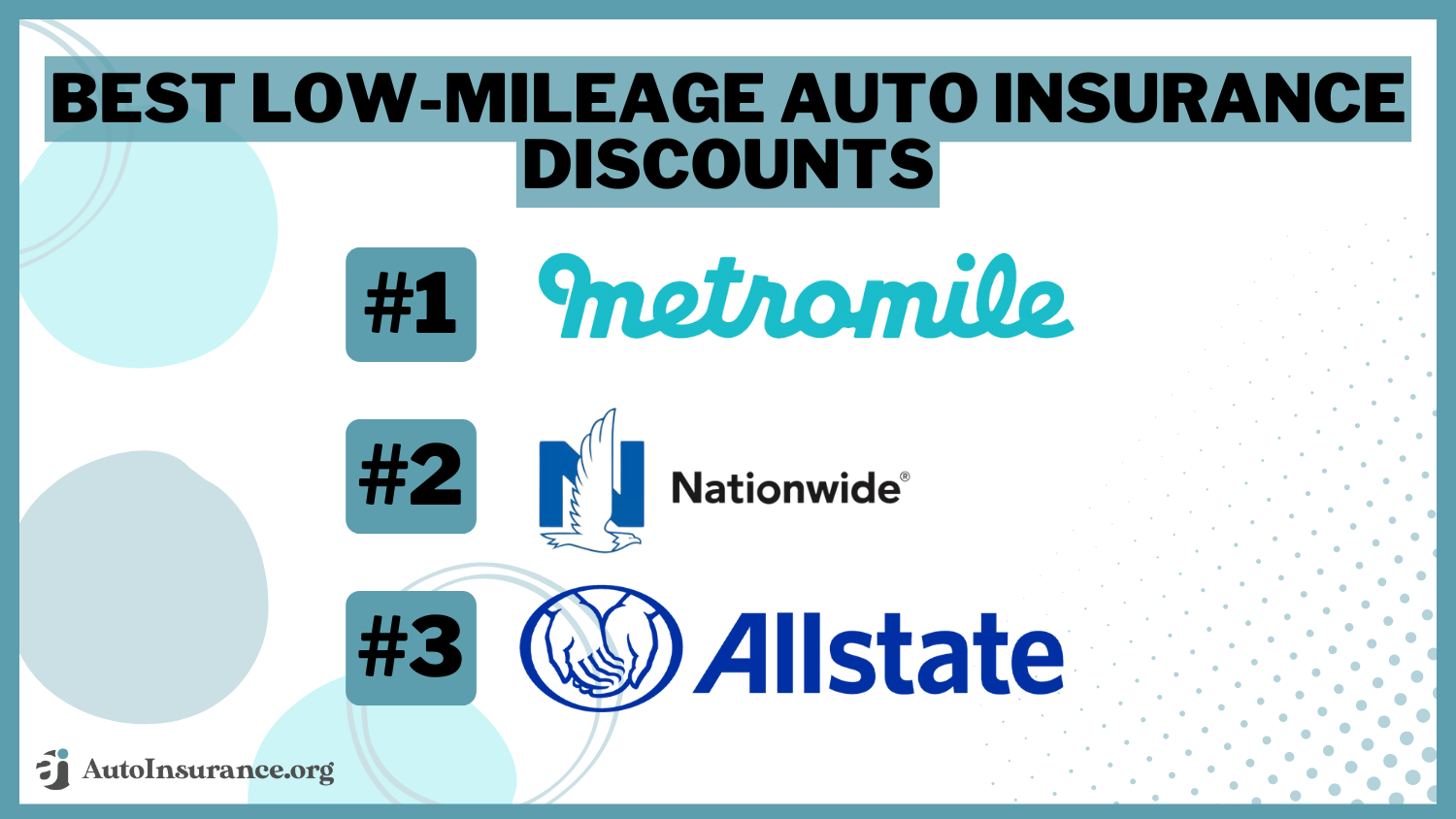

- Low Mileage Discounts: Driving less can make you eligible for discounts, as less road time reduces the risk of accidents.

- Safety Features Discounts: Vehicles equipped with modern safety features like anti-lock brakes, airbags, and theft devices may qualify for additional savings.

- Payment Plan Discounts: Paying your premium in full or opting for automated payments can yield significant discounts.

Additionally, there are lesser-known discounts that could further reduce your premiums. Look out for:

- Occupational Discounts: Certain professions, like teachers or engineers, may be eligible for special discounts.

- Military Discounts: Active duty or retired military personnel often benefit from reduced rates.

- Loyalty Discounts: Long-term customers are often rewarded with lower premiums for their continued business.

- Defensive Driving Course Discounts: Completing a defensive driving course can demonstrate your commitment to safe driving, earning you a potential discount.

- Affiliation Discounts: Memberships in certain organizations or alumni associations can lead to exclusive insurance discounts.

Are You Missing Out? Uncovering the Best Auto Insurance Savings

In today's fast-paced world, many drivers are unaware of the potential savings they could be missing on their auto insurance policies. By actively researching and comparing different providers, you can uncover the best auto insurance savings available. Start by evaluating your current plan and identifying any unnecessary coverage that may be costing you more than needed. Consider shopping around and obtaining quotes from multiple insurance companies to find the best deal tailored to your needs.

Additionally, taking advantage of discounts can lead to substantial savings on your auto insurance premiums. Many insurers offer discounts for good driving records, bundling multiple policies, and even for completing defensive driving courses. Make sure to inquire about all possible discounts when speaking with your insurance agent. By being proactive and informed, you can potentially save hundreds of dollars each year on your auto insurance, ensuring that you are not leaving money on the table.

The Ultimate Guide to Crazy Auto Insurance Discounts You Never Knew Existed

When it comes to auto insurance discounts, most drivers are familiar with the basics like good driver or multi-policy discounts. However, there are some crazy auto insurance discounts that many consumers overlook. For example, did you know that some insurers offer discounts for being a member of certain organizations or alumni associations? Additionally, some companies provide savings for vehicles equipped with advanced safety features like automatic braking or lane departure warnings. This can significantly lower your premium, making it essential to inquire about specific discounts that pertain to your vehicle's safety features.

Another lesser-known source of crazy auto insurance discounts is the type of employment you have. Occupations in fields like education, health care, or public service may qualify you for exclusive discounts. Furthermore, some insurers incentivize low mileage drivers or those who work from home with special rates. If you’re passionate about maintaining a clean driving record, be sure to explore usage-based insurance programs that can reward you for safe driving habits with lower costs. Always remember to ask your insurance agent about any possible discounts you might be eligible for, as they can lead to substantial savings!