Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Whole Life Insurance: The Unsung Hero of Financial Security

Discover why whole life insurance is your ultimate ally in achieving financial security. Uncover the hidden benefits today!

What is Whole Life Insurance and How Does it Work?

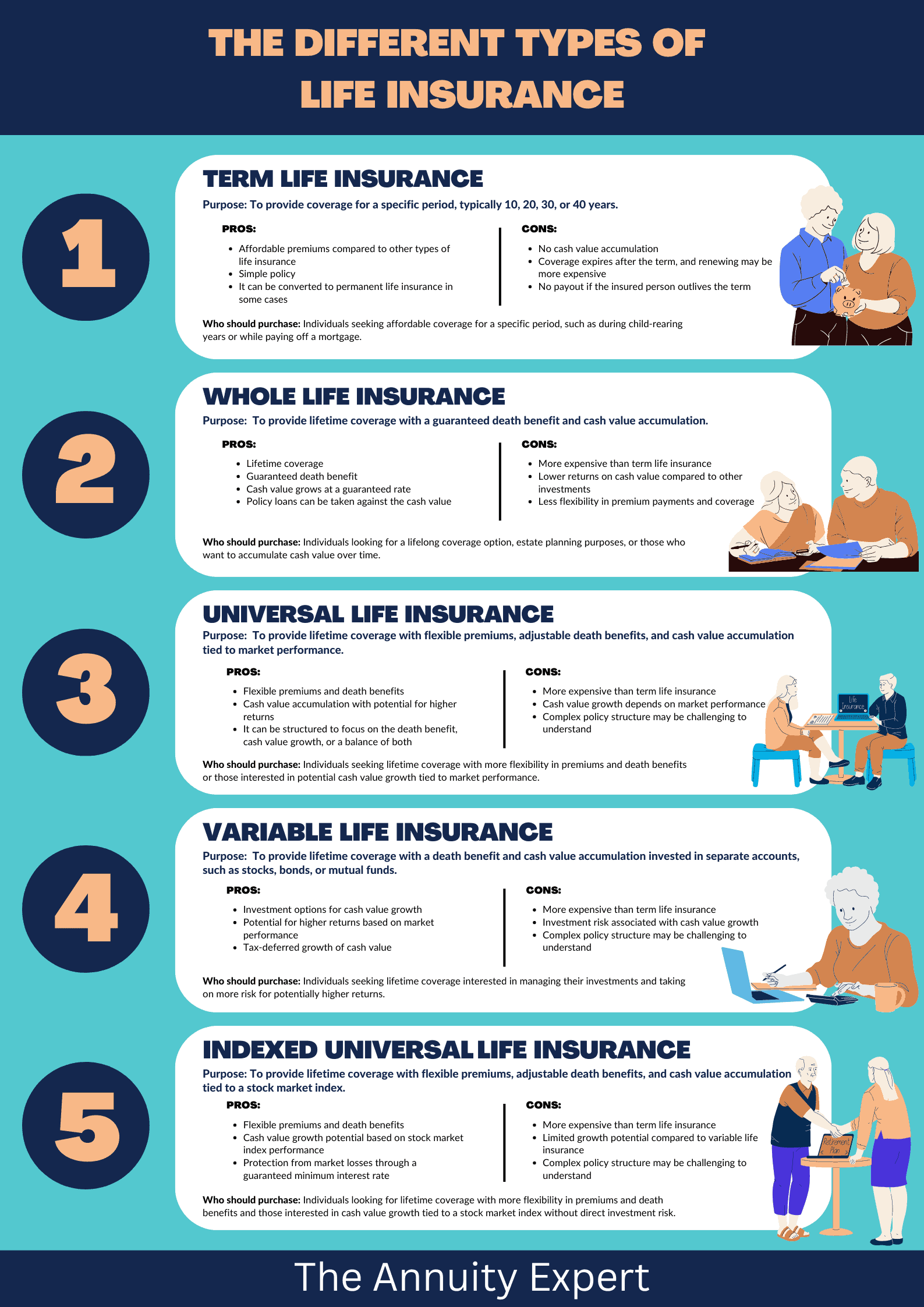

Whole life insurance is a type of permanent life insurance that provides coverage for the policyholder's entire life, as long as premiums are paid. Unlike term life insurance, which offers coverage for a specified duration, whole life insurance accumulates a cash value over time. This cash value grows at a guaranteed rate, making it an attractive option for those looking to build savings while ensuring financial protection for their beneficiaries. As the policyholder ages, the premiums remain level, providing predictability in financial planning.

When you purchase whole life insurance, a portion of your premiums goes towards the death benefit, while another portion contributes to the policy's cash value. Policyholders can access this cash value through loans or withdrawals, providing a source of funds for emergencies or opportunities. It's important to note that any unpaid loans or withdrawals will reduce the death benefit. Overall, whole life insurance offers a unique blend of lifelong protection and investment growth, making it a popular choice for individuals seeking long-term financial security.

5 Key Benefits of Whole Life Insurance: Your Path to Financial Security

Whole life insurance offers a unique blend of lifelong coverage and investment benefits, making it a powerful tool for achieving financial security. One of the primary advantages is that it provides a guaranteed death benefit, ensuring your loved ones are financially protected regardless of when you pass away. Additionally, whole life policies accumulate cash value over time, which can serve as a source of funds for emergency expenses or future investments. This dual benefit makes whole life insurance not only a safety net but also a vehicle for building wealth.

Moreover, whole life insurance comes with predictable premium payments that remain constant throughout the policyholder's life, allowing for effective financial planning. Another key benefit is tax advantages; the cash value growth is tax-deferred, meaning you won’t pay taxes on the growth until you withdraw it. These features combine to make whole life insurance a vital component of a comprehensive financial strategy, helping individuals and families achieve peace of mind and stability in their financial futures.

Is Whole Life Insurance Right for You? Exploring its Advantages and Disadvantages

When considering whether whole life insurance is right for you, it's essential to weigh both its advantages and disadvantages. One of the primary benefits is the permanent coverage it provides; as long as premiums are paid, your beneficiaries will receive a death benefit, regardless of when you pass away. Additionally, whole life insurance comes with a cash value component that grows over time, offering a degree of savings and potential borrowing options. This feature can be particularly appealing for those looking to integrate their life insurance policy with their long-term financial strategies.

However, there are notable downsides to whole life insurance that should not be overlooked. Primarily, the premiums are significantly higher than those of term life insurance, which can strain your budget, especially in the early years of the policy. Additionally, the cash value growth is often slow and can take several years to accumulate significantly. Moreover, if you choose to surrender your policy, you may face penalties that diminish your financial returns. Therefore, understanding your personal financial situation and future goals is crucial to determining if whole life insurance is indeed the right choice for you.