Buzz Haven: Your Source for Trending Insights

Stay updated with the latest buzz in news, trends, and lifestyle.

Why Your Auto Policy is the Best Place to Hide a Discount

Discover the hidden discounts in your auto policy! Unlock savings you didn’t know existed and boost your budget today!

Unlocking Hidden Savings: How Your Auto Policy Can Reveal Discounts

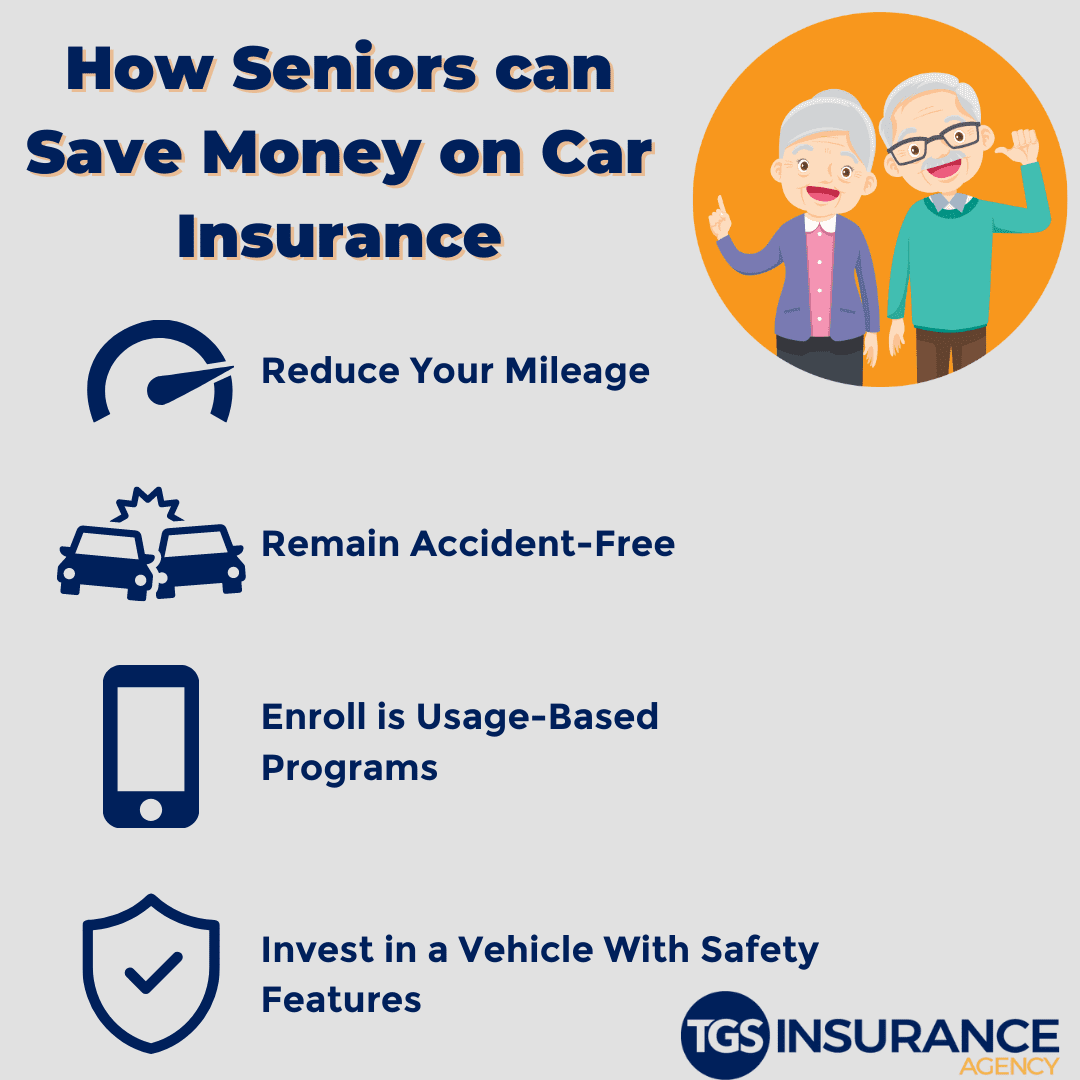

When examining your auto insurance policy, you might be surprised to discover that you could unlock hidden savings simply by revisiting your coverage options. Many insurance providers offer a variety of discounts that policyholders may not be fully aware of. For instance, you may qualify for discounts based on your driving history, the type of vehicle you own, or even your membership in specific organizations. To explore these potential savings, consider reviewing your policy annually and actively engaging with your insurance agent to discuss any new discount programs that may have become available.

Additionally, it’s essential to regularly assess your coverage. For example, if you’ve improved your driving habits, such as maintaining a clean driving record, you might be eligible for a good driver discount. Likewise, factors like bundling your auto insurance with other policies, such as home or renters insurance, can lead to significant cost reductions. Don’t hesitate to ask your insurer about multi-policy discounts or even low-mileage discounts if you don’t drive often. By taking these proactive steps, you can ensure that your auto policy is working for you and maximizing your potential savings.

Are You Missing Out? Discover Discounts in Your Auto Insurance Policy

Many drivers are unaware of the numerous discounts available in their auto insurance policies, which can lead to paying more than necessary. By doing a little research and asking the right questions, you could discover savings that significantly reduce your premiums. Common discounts include safe driver discounts, multi-policy discounts, and good student discounts. If you haven't reviewed your policy recently, now is the perfect time to explore these opportunities and ensure you're not missing out on substantial savings!

Additionally, staying informed about changes in your circumstances or in the insurance market can also unveil new discounts. For example, if you've recently upgraded your vehicle with safety features or completed a defensive driving course, these changes could qualify you for extra savings. Contact your insurance provider or check their website to find a comprehensive list of available discounts and see how you can maximize your auto insurance savings today.

The Secret Benefits of Bundling: How to Maximize Discounts in Your Auto Policy

Bundling your auto insurance with other policies, such as home or renters insurance, can lead to significant savings. Many insurance providers offer discounts for customers who choose to consolidate their coverage. This is not merely a promotional tactic; it reflects the provider's commitment to retaining loyal customers while allowing them to enjoy lower premiums. By opting for a bundled package, you can save money and simplify your finances by managing fewer policies. It’s a win-win situation!

Furthermore, bundling can enhance your insurance experience by streamlining communication and claims processing. When all your policies are under one provider, it becomes much easier to manage and understand your coverage. Should you ever need to file a claim, having a single point of contact can expedite the process. Additionally, many insurers offer exclusive benefits to bundled customers, such as accident forgiveness or enhanced coverage options. In essence, bundling not only maximizes your discounts but also offers peace of mind with comprehensive protection.