Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Why Your Coffee Habit Might Be Cheaper Than Disability Insurance

Discover why your daily coffee fix could cost less than vital disability insurance. Caffeine vs. coverage – what’s your best bet?

Is Your Daily Coffee Fix More Affordable Than Disability Insurance?

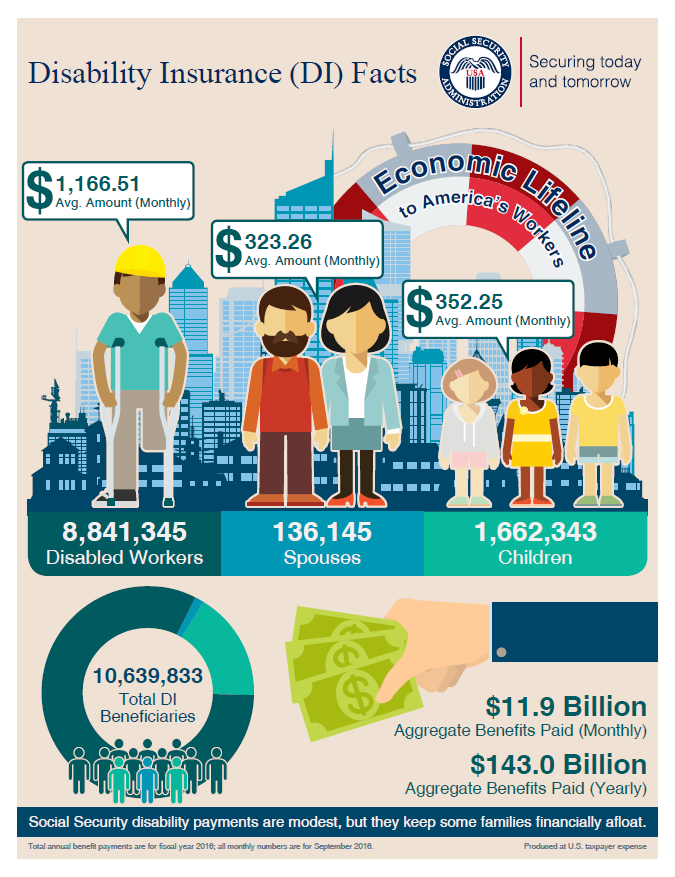

When considering your daily expenses, many people overlook the cumulative costs of their morning beverage ritual. A typical cup of coffee can range from $2 to $5 depending on where you buy it. If you indulge in a daily coffee fix, you could easily find yourself spending between $60 to $150 each month. In contrast, disability insurance, which provides financial support in case you are unable to work due to illness or injury, can often be obtained for a similar or lower monthly premium. For instance, many plans are available for around $50 to $100 per month, making them an affordable option compared to your daily caffeine habit.

While your daily coffee may bring you comfort and focus, it's essential to weigh its cost against more significant financial protections. Disability insurance not only safeguards your income but also secures your peace of mind. Here are a few points to consider:

- Investment in the Future: Unlike coffee, which is consumed daily, disability insurance is a long-term investment that can pay off in critical times.

- Potential Savings: If you were to switch from a daily coffee habit to purchasing disability insurance, you could experience substantial savings in the long run if an unexpected health crisis arises.

Ultimately, assessing whether your daily coffee fix is more affordable than disability insurance may encourage smarter financial choices that prioritize your future well-being.

The Hidden Costs: Comparing Your Coffee Habit to Disability Coverage

Many coffee lovers find themselves caught in a daily routine that revolves around their caffeine fix, yet few realize the hidden costs associated with this habit. On average, a premium coffee shop brew can cost around $4, translating to approximately $120 monthly and over $1,400 annually. While the aroma and flavor may enhance your day, it’s essential to reflect on how these expenses stack up over time. When considering the price of your daily cup, it’s worth pondering what other financial commitments you might be able to prioritize – such as disability coverage. Investing in a robust policy could offer significant long-term benefits, ensuring that you have financial support during unexpected changes in your health.

When comparing the investment in your daily cup of joe to that of disability coverage, it’s crucial to evaluate what each expense really means for your future. While that cozy cafe experience brings joy and comfort, the absence of a safety net for your income can have lasting repercussions. According to insurance experts, the odds of experiencing a disability during your working years are higher than many anticipate. This reality underscores the importance of creating security through insurance rather than indulgence. So, the next time you reach for your wallet to satisfy your coffee craving, consider the hidden costs of neglecting your financial health – a decision that could potentially shape your quality of life.

Why Prioritizing Your Coffee Budget Might Make Financial Sense Over Insurance

In today's fast-paced world, many individuals find themselves reevaluating their spending habits, and one intriguing consideration is the prioritization of your coffee budget. While it may seem trivial at first, allocating a portion of your finances to quality coffee can lead to a profound impact on your daily life. By focusing on your coffee budget, you may experience enhanced productivity and mental well-being, which could ultimately translate into better financial decision-making. Investing in a good cup of coffee might reduce the temptation to grab quick, less healthy snacks during the day, ultimately leading to savings.

Furthermore, when comparing the costs associated with your favorite brew to traditional insurance expenses, it's essential to analyze the benefits versus the burdens. While insurance can protect you from unexpected financial burdens, regular expenditure on coffee may foster an enjoyable routine that enhances your overall quality of life. In this context, prioritizing your coffee budget does not mean neglecting your insurance; rather, it represents a conscious decision to invest in everyday moments that contribute to your happiness and well-being. Thus, making your coffee budget a financial priority might just hold more value than you previously realized.