Buzz Haven: Your Source for Trending Insights

Stay updated with the latest buzz in news, trends, and lifestyle.

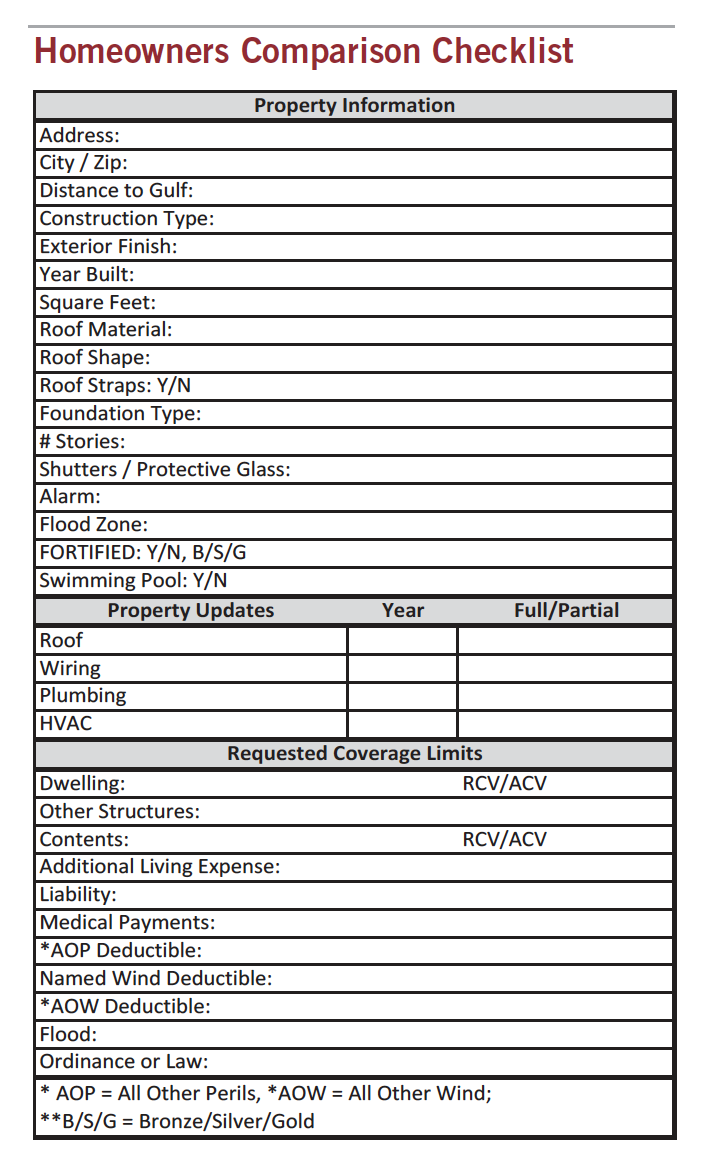

Behind the Curtain: The Great Insurance Comparison

Uncover the secrets of insurance with our ultimate comparison guide. Save money and find the best coverage today!

Understanding Your Policy: Key Factors to Consider When Comparing Insurance

When comparing insurance policies, it's essential to understand your policy thoroughly to ensure you're making the best choice for your needs. Start by examining the coverage limits provided by each option. This means looking closely at what is included in the policy, such as health benefits, liability protection, and other essential areas specific to your situation. Additionally, consider the deductibles associated with each policy, as this amount will impact your out-of-pocket expenses in the event of a claim. More granular aspects, such as exclusions, should also be carefully reviewed to avoid any unpleasant surprises later on.

Next, evaluate the premium costs for each policy, which may vary widely even for similar coverage. It's wise to ask yourself whether the monthly or annual premium aligns with your budget while still providing adequate protection. Don't overlook the insurer's reputation and claims handling process; policies are only as good as the companies backing them. Research customer reviews and ratings to gauge satisfaction levels regarding claims processing and customer service. By aligning these key factors, you'll be better equipped to choose an insurance policy that meets your unique requirements effectively.

The Hidden Costs: What to Look for in an Insurance Comparison

When it comes to shopping for insurance, comparing policies is essential, but it's equally important to be aware of the hidden costs that might affect your overall expenses. Many consumers focus solely on the premium, but factors such as deductibles, co-pays, and coverage limits can drastically change the final cost of your insurance policy. Hidden costs can include fees for early cancellation, policy changes, and additional coverage options that may not be apparent at first glance. To avoid surprises, it's crucial to read the fine print and fully understand what each policy entails.

Another consideration when conducting an insurance comparison is to analyze the claim process. Many policies may seem affordable, but if the claims process is known to be convoluted or has a high denial rate, that can result in significant financial strain later. Here's a quick list of what to look for when comparing insurance policies:

- Customer reviews about the claims experience.

- The availability of 24/7 support and assistance.

- Response times for claims processing.

- Any additional fees associated with filing a claim.

By examining these elements, you can make a more informed choice and steer clear of hidden costs that could burden you in the long run.

Insurance Showdown: How Do Different Providers Stack Up?

When it comes to choosing an insurance provider, a comprehensive insurance showdown is essential for making an informed decision. With numerous options available, it’s crucial to evaluate key factors that differentiate insurance companies. These factors include coverage options, customer service, and pricing structure. To get a clearer picture, it’s helpful to compare providers on these aspects:

- Coverage Options: Assess the range of policies offered.

- Customer Service: Check reviews and ratings.

- Pricing Structure: Analyze premium costs and deductibles.

In this insurance showdown, understanding how major providers stack up against one another can significantly impact your choice. For instance, Provider A may offer better customer service but at a higher premium, while Provider B may provide a budget-friendly option with limited coverage. It's important to weigh these factors according to your personal needs. Furthermore, customer reviews can give insights into the real-world experiences of others, often revealing the strengths and weaknesses of each provider. Ultimately, thorough research and comparison will empower you to select an insurance provider that best suits your specific requirements.