Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Policy Wars: Which Coverage Reigns Supreme?

Discover the ultimate showdown in insurance coverage! Uncover which policies truly reign supreme in the battle for your protection.

Understanding the Basics: How Different Policies Compare

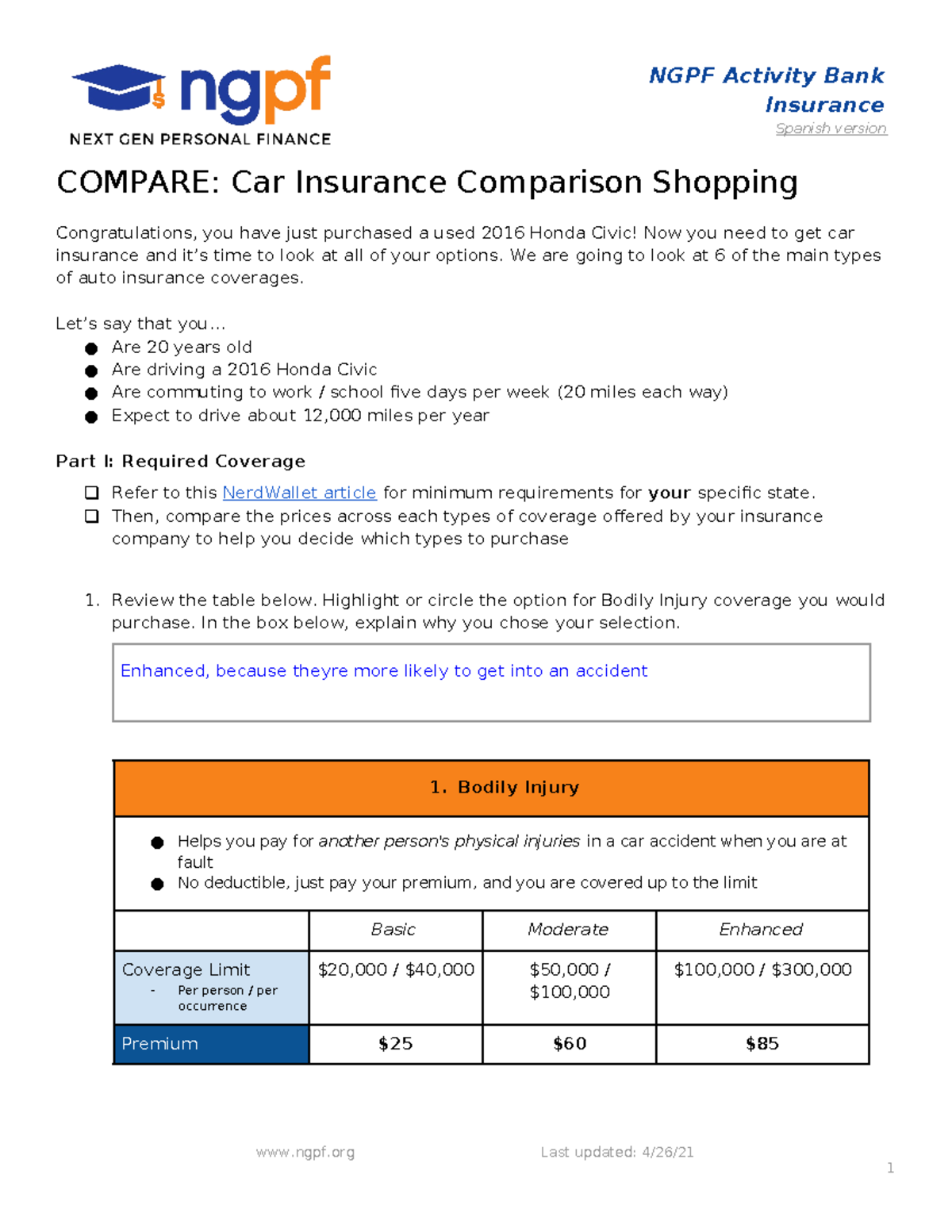

Understanding the basics of insurance policies can be daunting, especially with the myriad options available. To effectively compare different policies, it's essential to identify key elements such as coverage types, premium costs, and benefits included. By breaking down these components, consumers can evaluate which policy suits their needs best. For instance, policies may vary significantly in areas like deductibles and out-of-pocket expenses, which can ultimately affect the overall cost and value of the coverage.

Furthermore, evaluating customer service and claims processing is crucial when comparing policies. According to recent surveys, consumers often prioritize companies that not only provide comprehensive coverage but also offer responsive support. It's advisable to read reviews and seek out recommendations from trusted sources. By creating a simple comparison chart that lists the major attributes of different policies, individuals can make informed decisions that align with their financial goals and personal preferences.

Key Factors in Choosing the Right Coverage for Your Needs

Choosing the right coverage for your needs is essential to ensure adequate protection against unexpected events. Start by evaluating your specific situation, as each individual's circumstances can differ significantly. Consider factors such as your age, health condition, lifestyle, and financial situation. For instance, young professionals may require different coverage compared to retirees. It can be helpful to compile a list of your priorities, which could include health coverage, life insurance, or even property insurance, to better understand what you need.

Another key factor in selecting the right coverage is understanding the different types of policies available. Take the time to research and compare various options, looking into premium costs, deductibles, and coverage limits. Utilize online tools and consult with an insurance expert to clarify any confusing terms. Remember that the lowest price may not always provide the best value; instead, focus on finding a policy that adequately meets your requirements. In summary, a detailed evaluation and informed decision-making process are crucial components in achieving the right coverage for your needs.

Policy Wars: What You Need to Know About Coverage Options

The landscape of policy wars can be daunting, especially when it comes to understanding your coverage options. With various providers competing for your attention, it's essential to navigate through the noise to find what best suits your needs. First, identify the types of coverage available to you—this might include health insurance, auto insurance, and homeowners insurance, among others. By comparing policies and their corresponding premiums, deductibles, and limits, you can make a more informed decision that aligns with your financial goals.

In the midst of these policy wars, consumers often encounter diverse terminologies that can be confusing. Key terms such as co-payments, exclusions, and maximum out-of-pocket may vary significantly between policies. To help clarify, consider the following tips:

- Read the Fine Print: Ensure you understand the limits and exclusions of each policy.

- Seek Professional Advice: Consulting an insurance broker can provide personalized insights based on your specific circumstances.

- Stay Informed: Keep abreast of changes in policies and market trends to ensure you are getting the best coverage possible.

By knowing what to look for, you can better position yourself in the ongoing policy wars, ensuring that your coverage options not only protect you but also provide peace of mind.