Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Ditching Premiums: Discover Hidden Auto Insurance Discounts

Unlock secret auto insurance discounts and stop overpaying! Dive into our guide and save big today!

Unlocking Savings: A Guide to Hidden Auto Insurance Discounts

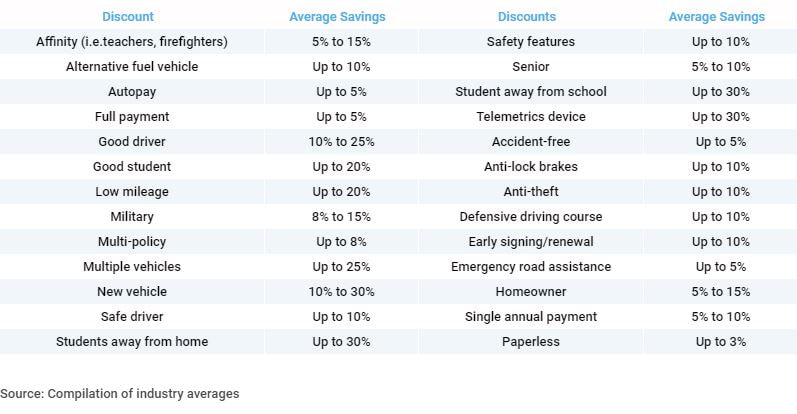

When it comes to auto insurance, many drivers are unaware of the myriad of hidden discounts that can significantly lower their premiums. These discounts can vary widely between insurers, but common ones include safe driver discounts, multi-policy discounts, and discounts for low mileage. For instance, if you have a clean driving record or bundle your auto insurance with other policies like homeowners or renters insurance, you may be entitled to substantial savings. Additionally, some insurers offer discounts for graduating from a defensive driving course, demonstrating that you are committed to safe driving practices.

To uncover these hidden auto insurance discounts, it's essential to have open communication with your insurance provider. Don’t hesitate to ask about any programs or savings you might qualify for, as many discounts go unadvertised and can easily be overlooked by consumers. Keep an eye out for seasonal promotions or special offers, particularly when renewing your policy. Remember, being proactive in seeking out these opportunities can result in considerable savings over time. Start by compiling a list of questions and potential discounts to discuss with your agent, and you might be surprised at how much you can save!

Are You Paying Too Much? Discover Overlooked Auto Insurance Discounts

Are you feeling the pinch of your auto insurance premium? You may be paying more than necessary without realizing it. Many drivers overlook valuable discounts that could significantly lower their rates. Common discounts include those for safe driving records, multiple policies with the same provider, and even good student discounts for young drivers. Discovering these overlooked auto insurance discounts could put money back in your pocket and decrease your financial stress.

In addition to the usual discounts, some insurers offer perks for features such as anti-theft devices, low annual mileage, or membership in certain organizations. You might also qualify for discounts simply by switching providers or paying your premium in full rather than in installments. Don't hesitate to ask your insurance agent about potential discounts; a little inquiry can go a long way in helping you save on auto insurance costs.

How to Find and Claim Hidden Discounts on Your Auto Insurance Policy

Finding and claiming hidden discounts on your auto insurance policy can significantly reduce your premiums. Start by reviewing your current policy to identify potential savings opportunities. Many insurers offer a variety of discounts that policyholders may overlook, such as safe driver discounts, which reward individuals with a clean driving record, and multi-policy discounts for bundling auto insurance with other types of coverage like home or renters insurance. Additionally, consider inquiring about low mileage discounts if you drive less than average, as well as discounts for having certain safety features in your vehicle.

Once you've identified potential discounts, it's essential to communicate with your insurance provider to ensure you're receiving all applicable savings. Contact your agent or the customer service department and ask specifically about hidden discounts that may not be clearly stated in your policy documents. It’s also a good idea to shop around and compare rates from different insurers, as some may offer more generous discount programs tailored to your needs. Keeping a proactive approach to your auto insurance policy not only helps you save money but also ensures you are fully informed about all available discount opportunities.