Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Insurance Discounts: The Hidden Treasure Behind Your Policy

Unlock hidden savings! Discover the insurance discounts you might be missing out on and maximize your policy's value today.

Unlocking Savings: How to Discover Insurance Discounts in Your Policy

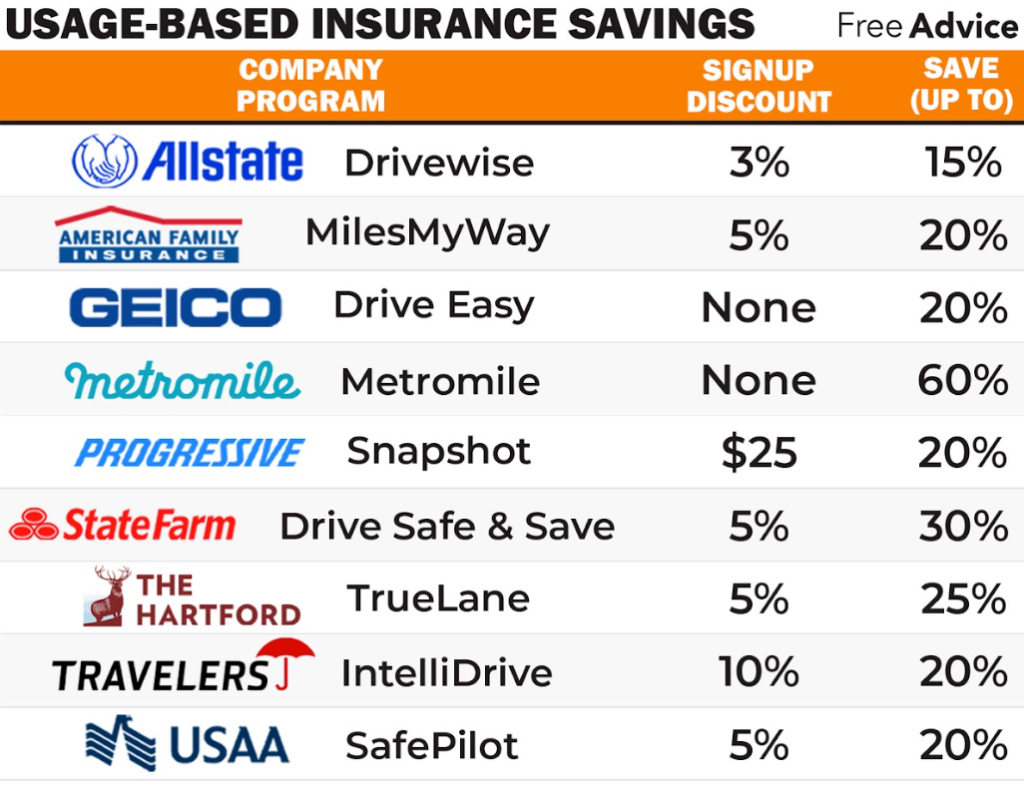

Insurance policies often come with a variety of discounts that can help you save money. However, many policyholders are unaware of the available options or fail to inquire about potential savings. To start unlocking discounts, review your policy and identify any areas where you may qualify, such as bundling multiple policies or maintaining a good driving record. Additionally, ask your insurance agent about discounts for safety features or loyalty programs. Don't hesitate to reach out and discuss your situation—your agent can provide invaluable insights and help you maximize your savings.

Another effective way to discover insurance discounts is by regularly comparing quotes from different providers. This not only helps you identify better rates but also reveals any discounts that may not have been available in your current policy. Make sure to look for discounts related to home security systems, claims-free records, or even affiliations with certain organizations, such as alumni groups or professional associations. By staying informed and proactive, you can unlock significant savings and ensure you are getting the best possible coverage for your needs.

Are You Missing Out? Common Insurance Discounts You Should Know About

Insurance can be quite a financial burden, but many policyholders are unaware of the multitude of insurance discounts available to them. Understanding these discounts can lead to significant savings on monthly premiums. For instance, most insurers offer discounts for bundling multiple policies, such as home and auto insurance. Additionally, safe driving records, being a student with good grades, or even installing security systems in your home can qualify you for reductions. It’s worth taking the time to ask your insurance provider about any available discounts.

Here are some common insurance discounts you might be missing out on:

- Multi-Policy Discounts: Save by bundling home, auto, or life insurance.

- Safe Driver Discounts: Avoid accidents and enjoy lower rates.

- Good Student Discounts: Students achieving a certain GPA may receive premium reductions.

- Home Safety Discounts: Install security alarms and smoke detectors to save.

Don’t leave money on the table; make sure to explore these opportunities to lower your insurance costs.

The Ins and Outs of Insurance Discounts: Maximizing Your Coverage Savings

Understanding insurance discounts is crucial for anyone looking to maximize their coverage savings. Many insurance providers offer a variety of discounts based on factors such as your driving record, the type of policy you choose, and even your profession. For instance, safe drivers can often qualify for a safe driver discount, while multiple policy holders may benefit from a bundling discount by combining auto and home insurance with the same provider. Additionally, discounts for having security features in your home or vehicle can significantly lower your premiums.

To take full advantage of these opportunities, it’s essential to regularly review your insurance policy and ask your agent about any potential discounts you may not be aware of. Here’s a quick checklist to consider when searching for insurance discounts:

- Review Your Current Policies: Assess your coverage to see if you qualify for discounts.

- Inquire About Aspects Like Payment Plans: Some insurers offer discounts for annual payments rather than monthly installments.

- Update Your Information: Keeping your personal and vehicle details up to date can help you receive all available discounts.