Buzz Haven: Your Source for Trending Insights

Stay updated with the latest buzz in news, trends, and lifestyle.

Insurance Policies: The Safety Net You Didn't Know You Needed

Discover the essential insurance policies that protect you from life's surprises—your safety net awaits! Don't miss out on peace of mind.

Understanding Different Types of Insurance Policies: Which One Is Right for You?

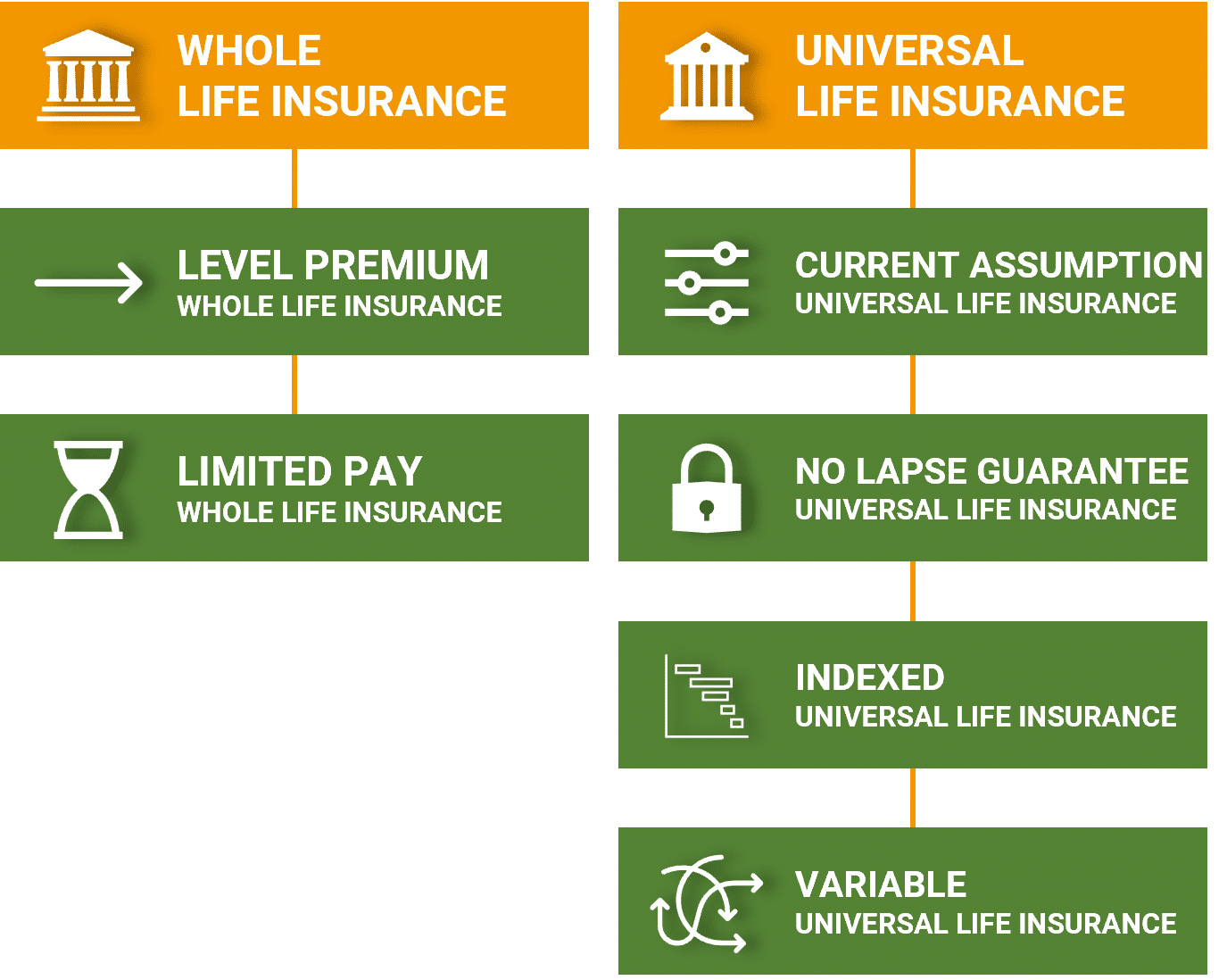

When navigating the world of insurance, it’s essential to understand the various types of insurance policies available to you. Broadly, insurance policies can be categorized into several types, including health insurance, life insurance, auto insurance, and homeowners insurance. Each type serves a distinct purpose: health insurance covers medical expenses, life insurance provides financial support to beneficiaries after the policyholder's death, auto insurance protects against vehicle-related incidents, and homeowners insurance safeguards your home and belongings against damages. Understanding these categories is the first step in deciding which policy aligns with your needs.

To determine the right insurance policy for you, start by evaluating your personal circumstances and potential risks. Consider factors such as your age, health, assets, and lifestyle. For example, if you have dependents, investing in life insurance might be crucial for their financial security. On the other hand, if you frequently travel or own a car, auto insurance is indispensable. Additionally, reviewing your options with a professional or using online comparison tools can help you weigh the benefits and costs of each policy. Ultimately, choosing the right insurance policy involves a careful assessment of your unique needs and priorities.

Common Misconceptions About Insurance Policies: What You Need to Know

When it comes to insurance policies, many individuals hold common misconceptions that can lead to costly mistakes. One prevalent myth is that all insurance policies are the same; in reality, different types of policies cater to various needs and circumstances. Understanding policy types—such as health, auto, and home insurance—is essential to ensure appropriate coverage. Consider the following points:

- Not all policies cover the same risks. Always read the fine print to know what is specifically included and excluded.

- Premium costs can vary significantly based on factors like age, location, and driving record, so it’s crucial to compare different offers.

Another misconception is that insurance is unnecessary if you are relatively healthy or have a low-risk lifestyle. Many people think, Why pay for insurance when nothing has happened so far?

However, even safe individuals can face unexpected events, such as accidents or illnesses. Here are a few reasons to reconsider:

- Financial security: Insurance provides a safety net that can prevent you from facing severe financial strain.

- Peace of mind: Knowing that you’re covered can help reduce anxiety about potential future risks.

How Insurance Policies Act as Your Financial Safety Net in Times of Crisis

In today's unpredictable world, having insurance policies in place can serve as a crucial financial safety net during times of crisis. Whether it’s a sudden medical emergency, an unexpected job loss, or property damage due to a natural disaster, insurance can help mitigate the financial burden on individuals and families. By paying a manageable premium, policyholders can ensure that they are protected against potentially devastating costs that could otherwise disrupt their lives and finances.

Moreover, the peace of mind that comes with knowing you are covered cannot be overstated. For instance, health insurance can significantly reduce out-of-pocket expenses for medical treatments, while homeowners or renters insurance can safeguard against losses caused by theft or damage. Additionally, life insurance provides a financial cushion for loved ones in the event of an untimely death, ensuring that they are not left struggling to meet their obligations. In essence, having the right insurance policies in place acts as a vital buffer, allowing individuals to navigate crises more effectively without facing financial ruin.