Buzz Haven: Your Source for Trending Insights

Stay updated with the latest buzz in news, trends, and lifestyle.

Insurance Quotes: The Secret to Saving Big

Unlock massive savings with insider tips on insurance quotes! Discover the secrets to finding the best deals today.

5 Tips for Comparing Insurance Quotes and Saving Money

When it comes to comparing insurance quotes, it's essential to gather as much information as possible to make an informed decision. Start by identifying your coverage needs—whether for auto, home, or health insurance. Once you have a clear understanding of what you require, obtain quotes from multiple insurers to ensure you're not overlooking better options. Utilize online comparison tools that allow you to see various policies side by side, which can help in pinpointing discrepancies and savings.

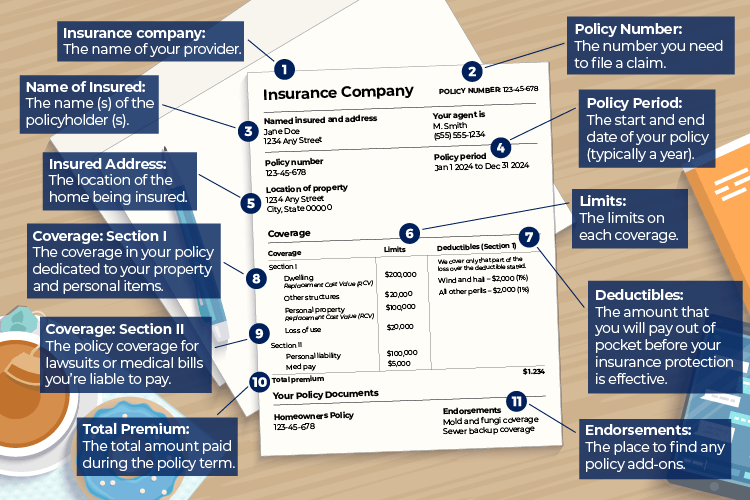

Next, don't just look at the premium costs; delve deeper into the details by reviewing the policy limits, deductibles, and coverage exclusions for each quote you receive. Sometimes a lower premium might result in less coverage, which could lead to higher out-of-pocket expenses in the event of a claim. Make a checklist of the key factors to consider while comparing these quotes, focusing on both price and the quality of coverage. Always remember that taking the time to do thorough research can significantly enhance your chances of saving money in the long run.

What Factors Influence Your Insurance Quotes?

When seeking insurance quotes, several factors play a crucial role in determining the final price you will receive. One of the primary factors is your personal information, which includes your age, gender, and marital status. For instance, younger drivers may face higher auto insurance quotes due to their inexperience behind the wheel. Additionally, the type of coverage you select, whether it's comprehensive or liability, can significantly affect your premium. Other important elements include the deductible amount and the specific insurance provider's criteria, which may vary widely. Understanding these factors can help you make informed decisions and optimize your insurance costs.

Another essential aspect that influences your insurance quotes is your claims history. If you have a record of frequent claims, insurers may view you as a higher risk, resulting in elevated premiums. On the other hand, maintaining a clean claims record can often lead to discounts or better rates. Your credit score also plays a significant role; many insurers use it as a predictor of risk, meaning that a higher credit score may improve your chances of receiving lower quotes. Lastly, factors such as location, vehicle type, and usage can further impact your rates. Recognizing these variables can empower you to shop for the best insurance options tailored to your needs.