Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Snagging Savings: The Sneaky Secrets of Auto Insurance Discounts

Unlock hidden auto insurance discounts and save big! Discover the sneaky secrets to snagging savings today!

10 Lesser-Known Auto Insurance Discounts You Might Qualify For

Auto insurance can be a significant monthly expense, but many drivers overlook various discounts that could reduce their premiums. Here are 10 lesser-known auto insurance discounts you might qualify for:

- **Good Student Discount**: If you're a student maintaining a GPA of 3.0 or higher, many insurers offer discounts.

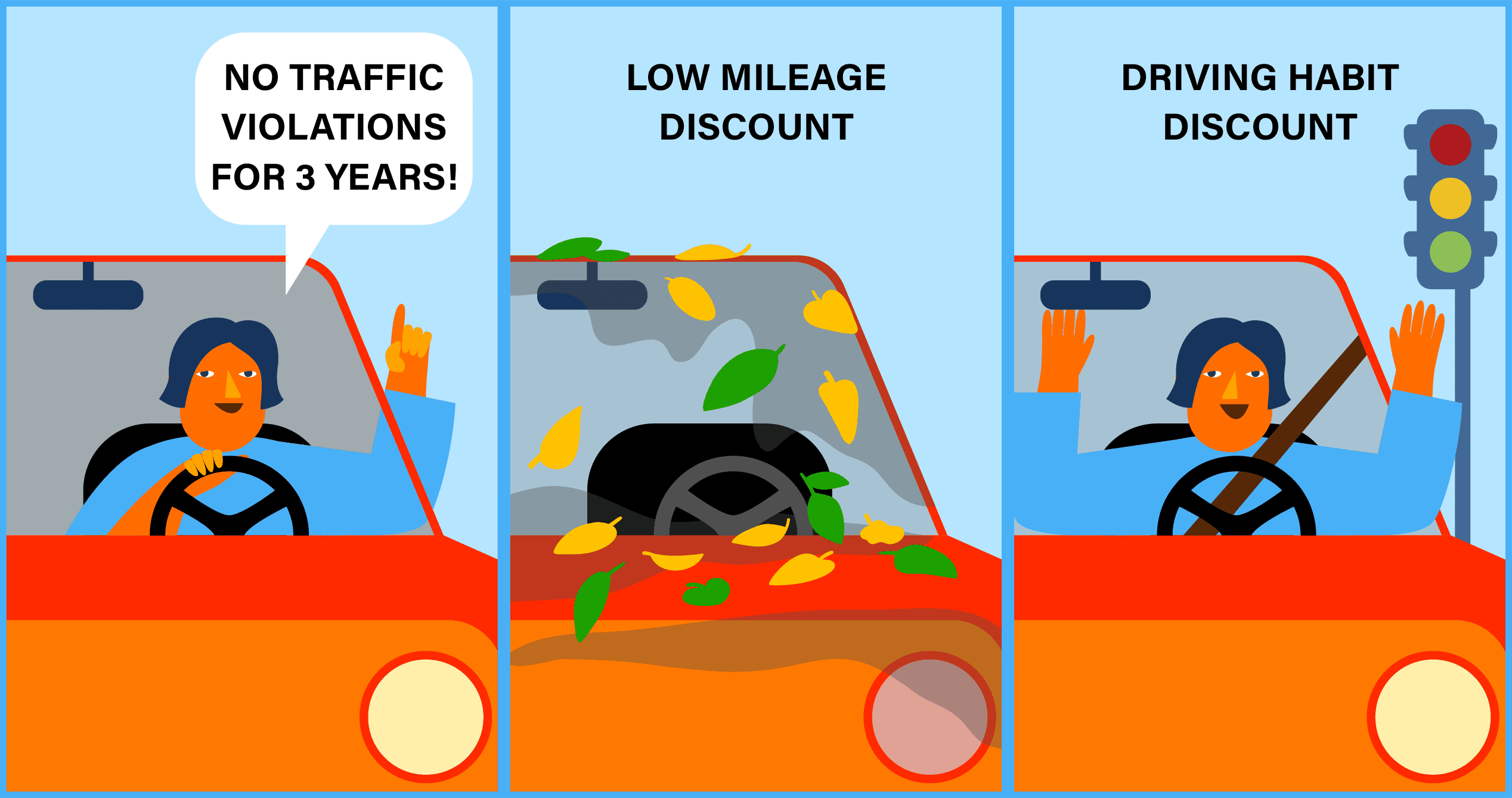

- **Low Mileage Discount**: If you drive less than a certain number of miles each year, you could receive a discount.

- **Bundling Discount**: Consider bundling your auto insurance with other policies, such as home or renters insurance, for a substantial savings.

- **Vehicle Safety Features Discount**: Cars equipped with advanced safety features can lead to lower premiums.

- **Usage-Based Insurance Discount**: Programs that track your driving habits may reward safe driving with discounts.

Other discounts to consider include:

- **Military Discount**: Active duty or retired military personnel often qualify for additional savings.

- **Senior Discount**: Many companies provide discounts for senior drivers, reflecting their typically lower accident rates.

- **Claims-Free Discount**: A history of no claims can also earn you a reduction in your premium.

- **Pay in Full Discount**: Paying your annual premium upfront instead of monthly can sometimes result in a discount.

- **Professional Association Discount**: Members of certain professional organizations may benefit from exclusive auto insurance discounts.

Be sure to ask your insurance provider about these lesser-known discounts that might help you save on your policy!

Is Your Insurance Premium Higher Than It Should Be? Discover Hidden Savings!

If you’re asking yourself, Is your insurance premium higher than it should be? you're not alone. Many policyholders are unknowingly overpaying for their coverage due to various factors such as outdated information, lack of shopping around, or not taking advantage of available discounts. It's essential to regularly review your insurance policies to identify any areas where you might be losing out on savings. Here are some common reasons why premiums can be inflated:

- Inaccurate personal information.

- Failure to update coverage needs.

- Not bundling insurance policies.

Discovering hidden savings on your insurance premium is easier than you think. Start by reaching out to your insurance provider and asking about applicable discounts—many companies offer reductions for safe driving, multiple policies, or even maintaining excellent credit. Additionally, consider comparing rates from different insurers to ensure you're getting the best deal. Finally, don't hesitate to negotiate your premium; sometimes a simple conversation can yield significant savings. Take the time to evaluate your current situation, and you might find that your premium can be lowered more than you anticipated!

How to Negotiate Auto Insurance Rates: Tips for Maximum Savings

Negotiating auto insurance rates can often feel overwhelming, but with the right approach, you can achieve maximum savings on your policy. Start by gathering quotes from multiple insurance providers. This allows you to compare coverage options and identify the lowest rates available. Don’t hesitate to use online comparison tools or reach out to local agents for personalized quotes. Additionally, consider your current policy and compile a list of any discounts you may qualify for, such as safe driving, multi-policy, or low mileage discounts.

Once you have your information ready, call your insurance provider to discuss your current rate. Be prepared to present the competitive quotes you’ve gathered and include any improvements in your driving record or changes in your circumstances that could warrant a better rate. Do not shy away from negotiating; a simple conversation mentioning your research can lead to significant savings. If your existing provider cannot meet the rates you’ve found, don’t hesitate to switch to another company that values your business with lower premiums.