Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

When Life Throws Curveballs: Why Disability Insurance is Your Safety Net

Discover how disability insurance can shield you when life takes unexpected turns. Don't leave your future to chance!

Understanding Disability Insurance: Your Essential Safety Net

Understanding Disability Insurance is crucial for anyone looking to protect their financial future against unforeseen circumstances. This type of insurance provides a safety net that can replace a portion of your income should you become unable to work due to a disability. The importance of having this coverage cannot be overstated, as it ensures that you can maintain your standard of living and meet essential expenses, such as housing, utilities, and medical bills. Moreover, most people underestimate the likelihood of experiencing a disability during their working years; in fact, studies show that nearly 1 in 4 individuals will face a disability before retirement age.

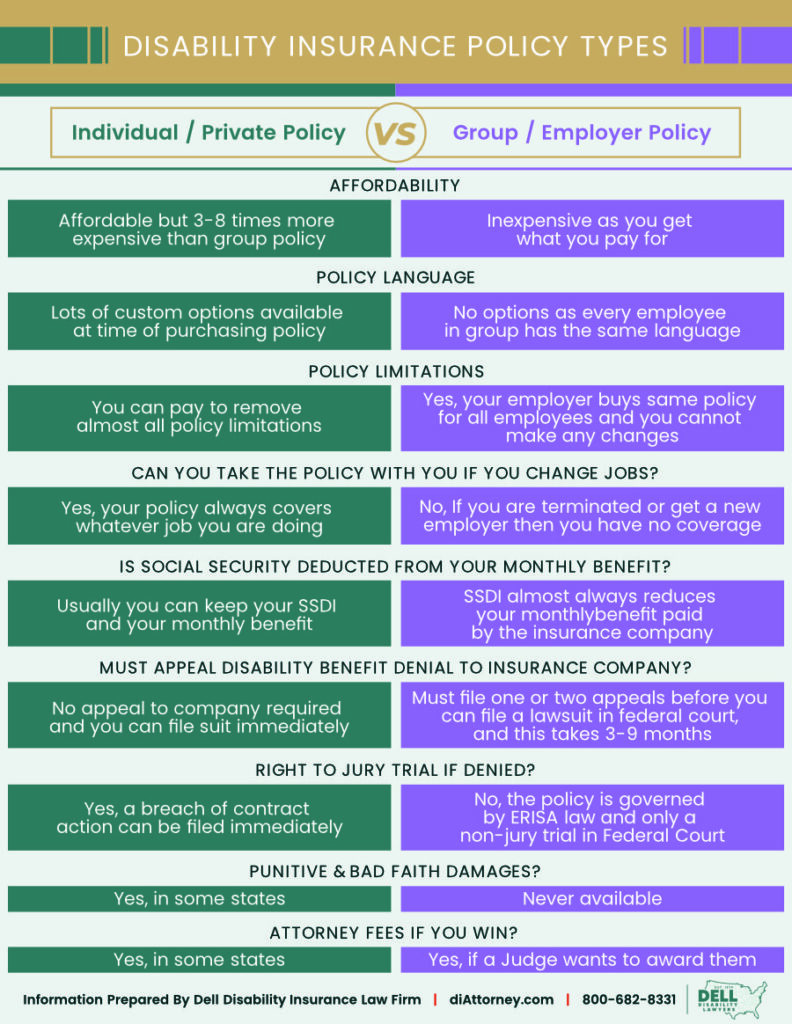

When considering your options for Disability Insurance, it's essential to understand the different types available. There are typically two main categories: short-term disability insurance and long-term disability insurance.

- Short-term disability insurance provides coverage for a limited time, usually ranging from a few months up to a year.

- Long-term disability insurance kicks in after short-term coverage ends and can last for several years or even until retirement age.

How Disability Insurance Can Protect You When Life Gets Unpredictable

Disability insurance serves as a crucial safety net for individuals facing the unpredictability of life. When unforeseen circumstances such as illness or injury strike, the impact can be devastating, leading to loss of income and increased financial stress. This type of insurance provides a steady stream of income, ensuring that you can maintain your standard of living and cover essential expenses, such as housing, healthcare, and daily essentials. By investing in disability insurance, you are making a proactive choice to protect yourself and your family from the financial hardships that often accompany life’s unexpected challenges.

Furthermore, the peace of mind that comes with having disability insurance cannot be overstated. Knowing that you have a financial cushion helps reduce anxiety about the future, allowing you to focus on recovery and adaptability. Many policies offer various coverage options, from short-term to long-term benefits, tailored to meet your needs. With the right coverage in place, you can navigate life’s uncertainties with confidence, knowing that you have taken steps to safeguard your financial well-being during difficult times.

Top 5 Reasons Why Disability Insurance is Crucial for Your Financial Security

Disability insurance is an essential financial safety net that protects your income when you are unable to work due to illness or injury. One of the top reasons to consider it is the unforeseen nature of disabilities. According to statistics, approximately one in four workers will experience a disability that lasts for at least 90 days during their career. This means that without sufficient coverage, you could face significant financial hardships, including difficulty in meeting daily expenses or paying off debts. By securing disability insurance, you can mitigate these risks and ensure that you maintain your financial stability even during challenging times.

Another compelling reason to prioritize disability insurance is the rising costs of healthcare and living expenses. If you are unable to work, your income may be severely impacted, but bills will continue to accumulate. With disability insurance, you can receive a portion of your income, allowing you to cover essential expenses, such as housing, utilities, and medical bills. This financial support serves as a buffer, preventing the need to deplete your savings or rely on family and friends for assistance. In summary, having disability insurance not only secures your financial future but also grants you peace of mind in knowing that you are protected from unexpected life events.