Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Whole Life Insurance: The Lifebuoy You Didn't Know You Needed

Discover how whole life insurance can be your unexpected financial lifebuoy—secure your future today and protect what matters most!

What is Whole Life Insurance and How Does It Work?

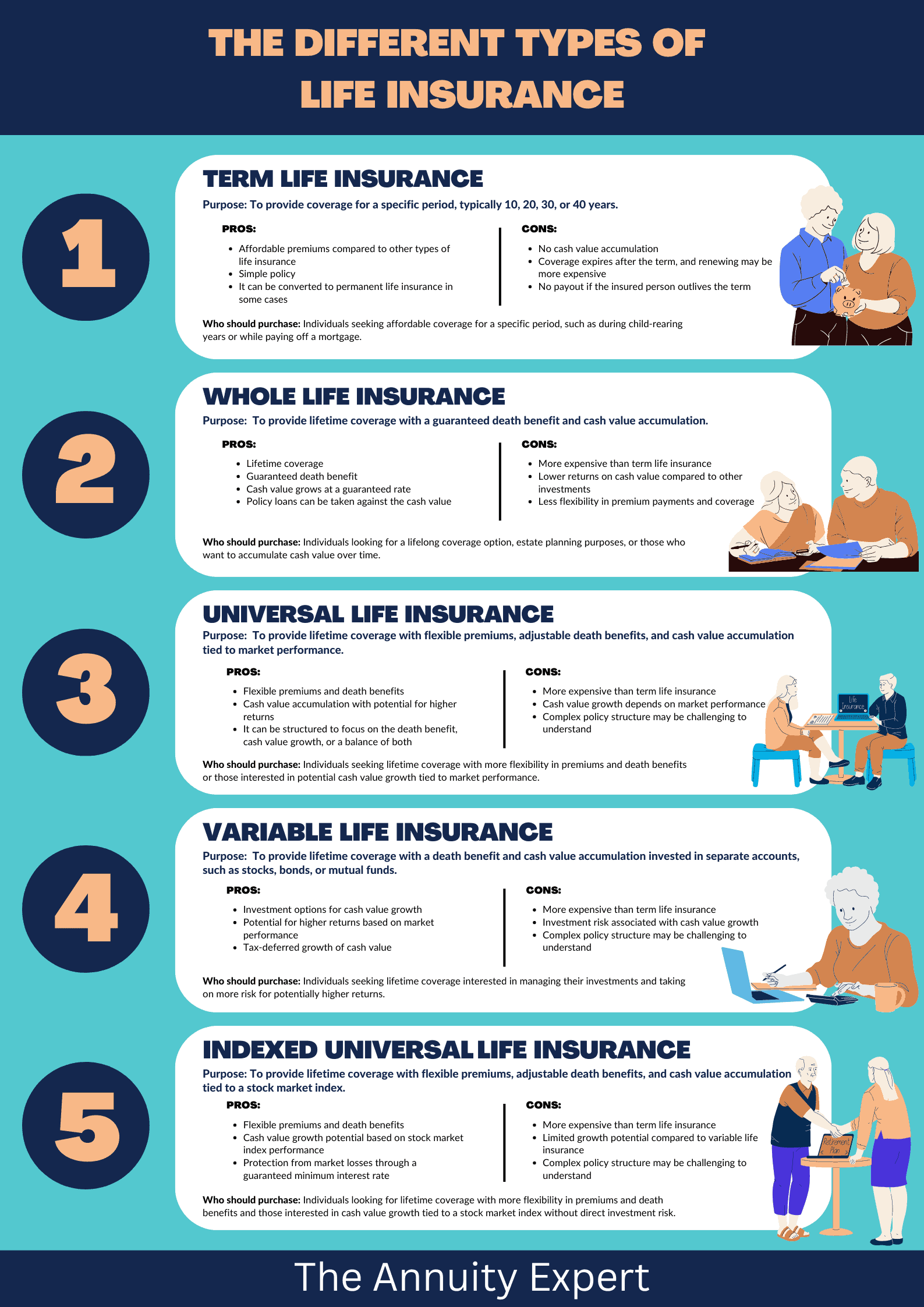

Whole life insurance is a type of permanent life insurance that provides coverage for the policyholder's entire life, as long as premium payments are maintained. Unlike term life insurance, which only offers coverage for a specific period, whole life insurance accumulates cash value over time. This cash value can serve as a savings component, allowing policyholders to borrow against it or withdraw funds as needed. Additionally, whole life insurance policies typically come with a guaranteed death benefit, ensuring that beneficiaries receive a specified amount upon the policyholder's death, giving them peace of mind and financial security.

Understanding how whole life insurance works is crucial for anyone considering this financial product. The premiums for whole life policies are generally higher than those for term life due to the lifelong coverage and cash value accumulation. These premiums are paid either monthly or annually, and a portion of each payment goes toward the death benefit, while another portion contributes to the cash value. Over time, the cash value grows at a guaranteed rate, providing a potential source of funds for emergencies or retirement. Policyholders can also receive dividends from participating whole life insurance policies, further enhancing their savings potential.

The Key Benefits of Whole Life Insurance: A Comprehensive Guide

Whole life insurance is a financial product that provides a range of benefits, making it a viable option for those looking to secure their financial future. One of the primary advantages is its guaranteed death benefit, which ensures that your beneficiaries will receive a predetermined amount regardless of when you pass away. This aspect can offer peace of mind and financial security for your loved ones. Additionally, whole life insurance policies accumulate cash value over time, which serves as a savings component. This cash value can be accessed through loans or withdrawals, providing you with extra funds during emergencies or for other financial needs.

Another compelling benefit of whole life insurance is its fixed premium rates. Unlike term life insurance, where premiums can increase upon renewal, whole life insurance offers consistent payments throughout the life of the policyholder. This predictability allows for better budgeting and financial planning. Furthermore, the policy's cash value grows at a competitive interest rate, which can contribute to a strong financial foundation for future investments or retirement planning. By choosing whole life insurance, you not only secure a death benefit but also create a long-term savings tool that enhances your overall financial strategy.

Is Whole Life Insurance Right for You? Key Considerations to Evaluate

When considering whole life insurance, it's crucial to evaluate your financial goals and circumstances. This type of policy offers lifelong coverage and an investment component that can accumulate cash value over time. Start by assessing your current financial obligations, such as debts and dependents, to determine if the benefits of whole life insurance align with your needs.

Another important factor is the cost associated with whole life insurance. These policies typically come with higher premiums compared to term life insurance. Be sure to create a budget that includes these costs and consider the long-term financial commitment. To help you decide, think about the following key considerations:

- Your age and health status

- Your financial objectives

- The level of coverage you require

- Alternatives available in the market