Buzz Haven: Your Daily Dose of News

Stay informed and entertained with the latest buzz in news, trends, and insights.

Whole Life Insurance: The Policy That Lives on Forever

Discover how whole life insurance can be your everlasting financial safety net. Learn why it’s a smart choice for lifelong security!

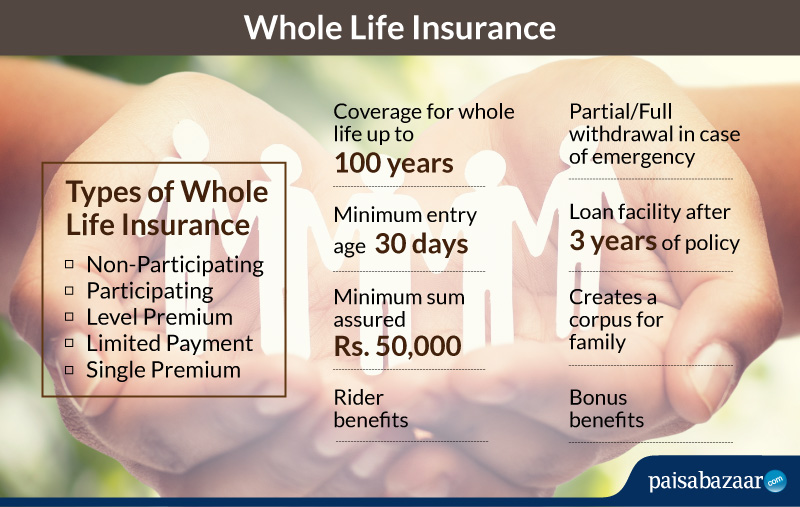

Understanding Whole Life Insurance: Key Benefits and Features

Whole life insurance is a type of permanent life insurance that provides lifelong coverage and combines both a death benefit and a cash value component. One of the key benefits of whole life insurance is its predictability; policyholders can benefit from fixed premiums that remain constant throughout the life of the policy. Additionally, the cash value accumulates at a guaranteed rate, which can be accessed through loans or withdrawals, providing financial flexibility in times of need. This makes whole life insurance not just a safety net for your loved ones, but also a valuable financial asset.

Another significant feature of whole life insurance is its ability to provide peace of mind through lifelong coverage. Unlike term life insurance, which only lasts for a specified period, whole life insurance ensures that your beneficiaries will receive a death benefit no matter when you pass away, as long as premiums are paid. Furthermore, many whole life policies also offer the potential for dividends, which can enhance the policy's cash value and provide additional benefits over time. In summary, understanding these key advantages can help individuals make more informed decisions about their insurance needs.

Is Whole Life Insurance Right for You? Factors to Consider

When evaluating if whole life insurance is right for you, it's essential to consider your financial goals. Unlike term life insurance, which provides coverage for a specific time period, whole life insurance offers lifelong protection and includes a savings component that grows over time. This dual benefit can be attractive for those looking for more than just a safety net. However, the premiums are significantly higher, so it's crucial to assess your budget and determine if the added cost aligns with your overall financial plan.

Another factor to consider is your personal circumstances. Whole life insurance can be particularly beneficial if you have dependents or significant financial obligations, as it ensures that your loved ones receive a guaranteed payout regardless of when you pass away. Moreover, if you're looking for a way to build cash value that can be borrowed against or used for future expenses, whole life might be a suitable choice. Ultimately, weigh the pros and cons in relation to your specific situation, and consider consulting a financial advisor to make an informed decision.

How Whole Life Insurance Can Provide Lifelong Financial Security

Whole life insurance is a powerful financial tool that offers lifelong coverage and security to policyholders. Unlike term insurance, which only provides protection for a specified period, whole life insurance ensures that your beneficiaries receive a death benefit no matter when you pass away. This feature not only provides peace of mind, but it also helps in planning for long-term financial needs, making it an essential component of a robust financial strategy. In addition to the death benefit, whole life policies accumulate cash value over time, which policyholders can borrow against or withdraw in times of need, adding another layer of financial flexibility.

Investing in whole life insurance can be particularly beneficial for those looking to build a legacy. The cash value component grows at a guaranteed rate, which makes it a stable option for those who want to ensure their financial future and that of their loved ones. Additionally, the death benefit is generally tax-free, providing a tax-efficient way to transfer wealth. As a result, whole life insurance can not only serve as a safety net for your family but also as a strategic financial asset that contributes to your overall wealth accumulation over time.